The U.S. Tax Code is 75,000 pages and four million words long.

It’s too big. It’s too complicated. It creates waste and prevents prosperity.

It’s time to cut this code down to size.

That’s the message Young Americans for Liberty is bringing to college campuses this spring through their National Spring Activism project, “Ax The Tax.”

Young Americans for Liberty (YAL) is the largest and fastest-growing conservative and libertarian youth organization in the country, with over 900 chapters on college campuses across all 50 states.

Their mission: to identify, educate, train and mobilize student leaders into the liberty movement.

What sets YAL apart from other student organizations? They’ve created a culture of action on campuses and beyond.

What sets YAL apart from other student organizations? They’ve created a culture of action on campuses and beyond.

Young Americans for Liberty are directly changing campus policies, and even running for congress.

Their “Ax The Tax” initiative fits directly into their model of action. The goal? To flood campuses with a simple philosophy rejected by progressive faculty: less taxes means more freedom.

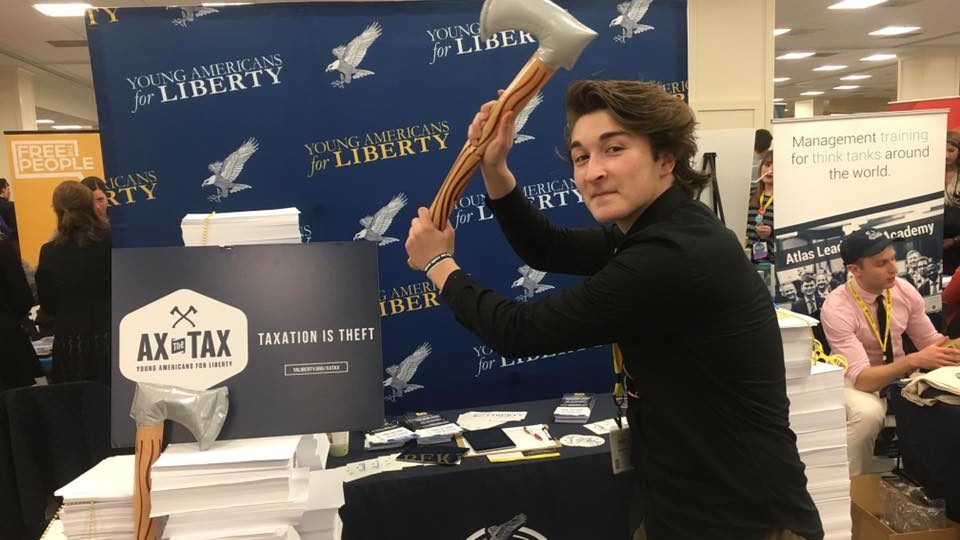

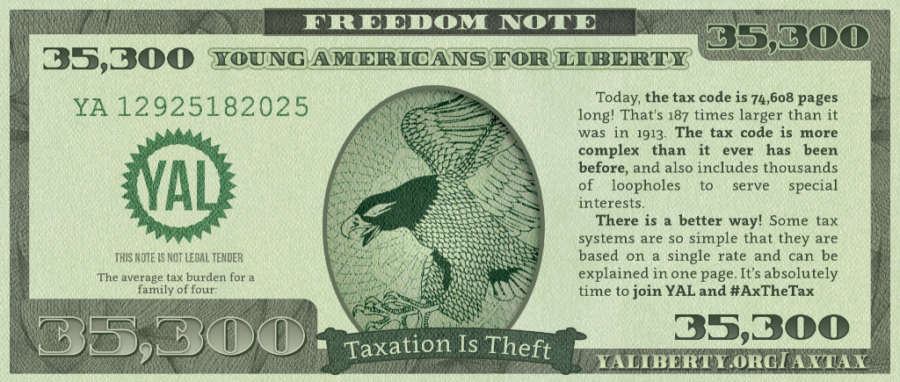

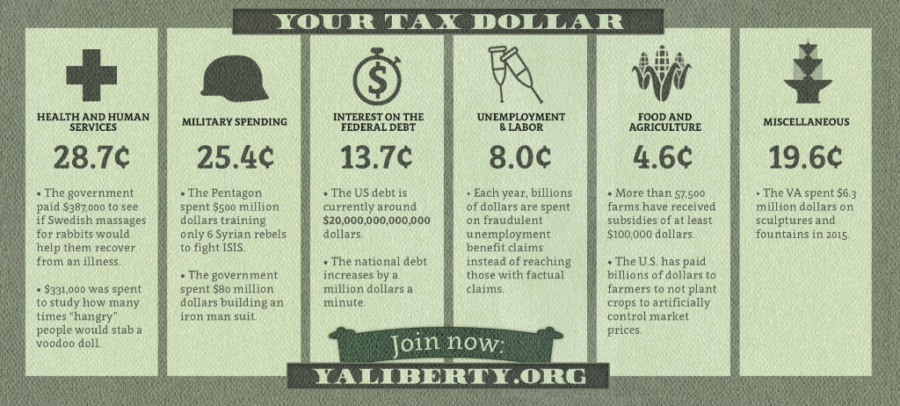

One component of the activism is direct engagement with other students. A popular choice YAL leaders are making is to build replicas of the 75,000-page tax code in their student unions, and offer a photo op with them swinging a blow-up ax. Once they’ve grabbed students’ attention, activists offer them pamphlets informing them where their tax dollars are going, highlighting the waste the government incurs.

Last week, YAL leaders used social media to take massive action on spreading this free market message. The organization used its national Facebook account to feature Professor Antony Davies of Duquesne University to give a live talk titled “The Robin Hood Myth: Why Taxing the Rich Won’t Work.”

With an unwavering tone of certainty, Davies presented evidence showing the government doesn’t have a revenue problem; how increasing tax rates actually lowers tax revenue; and that top earners are already paying what most Americans consider a “fair share” of taxes.

After dismantling these progressive fallacies, Davies discussed what he considers the greatest harm caused by excessive taxation: the vilification of entrepreneurship.

Davies believes that if society creates an environment that demonizes the rich and taxes away their success, “not-yet-rich” entrepreneurs will be dissuaded from pursuing taking the initial risk to get started.

“What if Bill Gates didn’t risk dropping out of Harvard to start Microsoft?” Davies asks. “Microsoft employees 118,00 people, with median starting salaries at $90,000. If we pushed him to not take that initial risk, all of these jobs and the capital Gates created would be gone.”

Perhaps Gates will consider this the next time he publicly advocates to raise taxes on his income bracket.

During a live Q&A period with students, a participant asked what individuals can do as advocates to reduce the tax code. Davies encouraged the audience to start by grounding themselves in American history and commit to free market alternatives as a means to help society’s neediest.

Before President Johnson’s instituted the Great Society entitlement program in the 1960s, individuals voluntarily sought assistance from their neighbors in community organizations like Lions and Rotary clubs. However, instead of turning to civil institutions in times of need, we now turn to government. “(Government) is all too happy to oblige,” Davies claims, “because more spending means more power for politicians.”

The cost of this societal shift is the quality of care people now receive. Free market principles explain the common sense behind this result.

“The Lions and Rotary Club have tremendous incentive to do their jobs well,” says Davies, “because they need to provide service for a good value at a low cost to stay alive. That dynamic made these organizations a beautiful solutions to this problem, and it’s exactly what government cannot do.”

“If a government program like social security is doing its job badly,” Davies continued, “politicians will create an excuse to give it more funding. It’s a perverse incentive!”

Less than 24 hours after Davies’ talk was released, it had reached over 10,000 views.

Knowledge is not power, but potential power, and it’s only good if people take action.

College students across the nation are now being exposed to the reality of our tax system. In a country where the average graduate carries an average of $37,172 in student loan debt, it’s a moral obligation to create a path to prosperity.

Like hundreds of Young Americans for Liberty are doing this spring, it’s time to stand up and announce this call to action: Ax The Tax.

MORE ABOUT TAXATION ON CAPITALISM.COM:

• I Just Paid Trump $300,000 in Taxes, Which is About Half of My Tax Burden for the Year

• How Our Complex Tax System Punishes Workers, Hinders Business Growth

• Should Robots Pay Taxes?