As a small business owner, you have a lot to worry about — managing employees, tweaking your marketing plan, and, of course, fulfilling your tax obligations. Concerning taxes, there is good news that can save you a lot of money. It's the Qualified Business Income (QBI) deduction that lets you deduct up to 20% of your qualified business income. If you want to learn more about this significant deduction, keep reading.

But first, a disclaimer. We are not tax professionals. We’re just entrepreneurs trying to help other entrepreneurs make more money, keep more of what they make, and create positive change in the world. You should consult your tax advisor rather than relying on anything we say here, there, or anywhere.

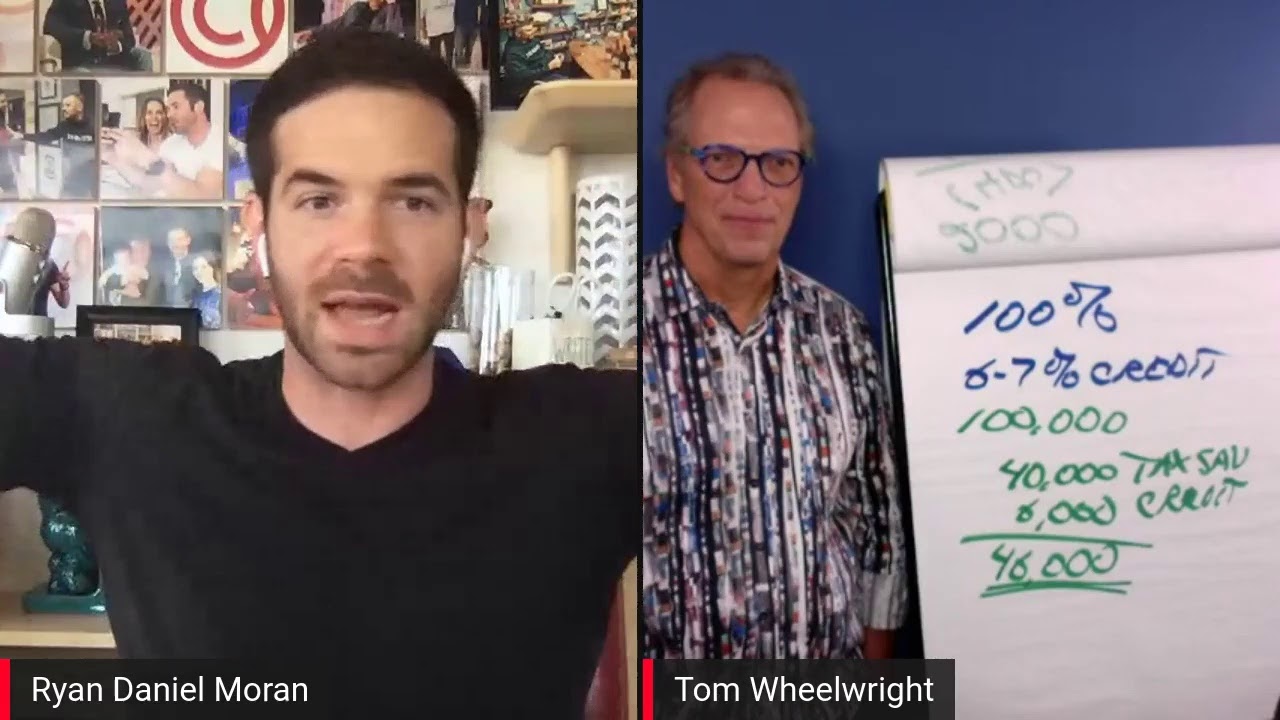

However, even though we aren’t experts, we know some! Here’s a recent discussion from inside The One Percent. We invited “Rich Dad, Poor Dad” tax strategist, Tom Wheelwright to talk to our community about how to virtually DELETE their taxes this year.

Qualified Business Income Deductions: What You Need to Know

What is the Qualified Business Income Deduction?

In 2017, President Trump passed the 2017 Tax Cuts and Jobs Act. Also called the 199A deduction, the QBI deduction "allows non-corporate taxpayers to deduct up to 20 percent of their QBI, plus 20% of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income." This deduction is available to sole proprietorships, S corporations, partnerships, and even trusts and funds.

Can You Define Qualified Business Income?

Before knowing whether you can deduct your qualified business income, let's first define qualified business income.

According to the IRS, qualified business income is the "net amount of qualified items of income, gain, deduction and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and certain trusts."

While this definition may seem like your income is all-encompassing, there are certain limitations. The IRS has an extensive list of what does NOT count as qualified business income, including:

For an extensive list and explanation of income that does not qualify for the QBI deduction, visit the IRS.

What Is The QBI Deduction For 2020?

Those who meet the following income criteria could claim the full 20% qualified business income deduction on their tax returns if you filed in early 2020. However, there are certain limitations on whether you exceed the income threshold:

For Married Couples Filing Joint Returns

For Single Filers

Qualified Business Income Deduction 2020

When you file your 2020 taxes in early 2021, "the threshold amount will increase to $326,600 for married couples filing joint returns, and $163,300 for all other filing statuses," according to Policy Genius.

Who Qualifies For Qualified Business Deductions? / Who Is Eligible For Section 199A Deduction?

There are specific eligibility requirements you must meet before you can consider the qualified business income deduction. These qualifications include:

Type of Business

The IRS specified the qualified business income is any income you generate from a Section 162 trade or business. However, there are a few exceptions to this rule:

First, the trade or business cannot be a C-corporation.

Second, your business cannot be a specified services trades or businesses (SSTB). An SSTB is a trade or business that delivers services within certain industries. Here are a few examples:

If your business meets the SSTB definition, you will have limitations on whether you qualify for the qualified business income deduction. We'll later explore some examples of how your SSTB status affects your QBI deduction eligibility.

For more information on specified service trades or businesses, visit the IRS website.

Business Structure

Your business structure must be a pass-through entity. A pass-through entity is a business type where you don't file your business income at the business level. Instead, your business income "passes through" to your individual income tax return.

In other words, you file your business income taxes — not your business.

If you're still confused, we understand. Generally, you should qualify for the QBI deduction if you have one of the following business entities:

Keep in mind that certain trusts and estates may also qualify for the business income deduction.

Business Income Sources

As we mentioned before, not all business income counts as qualified business income. Again, this may include:

You can refer to our earlier list of income that does NOT qualify for the qualified business income deduction.

Income Limitations

Whether you're an SSTB or not, you are subject to various income thresholds depending on your filing status. If you're an SSTB, more rules will affect the percentage you can deduct. According to the IRS, your deduction must be the lesser of:

- 20 percent of the taxpayer's QBI, plus 20 percent of the taxpayer's qualified REIT dividends and qualified PTP income' or

- Twenty percent of the taxpayer's taxable income minus net capital gain.

Whichever is lesser of these two options is the deduction you must take. However, if your total income exceeds the qualified business income deduction phase-out range, you would not qualify for the QBI deduction if you are an SSTB.

How Is Qualified Business Income Deduction Calculated?

Calculating your qualified business income deduction can get tricky. The QBI deduction debuted only in 2017. And even accountants and other financial professionals are still trying to wrap their heads around it.

Fortunately, you don't have to rely on yourself to see if you qualify. Using online tax return software or working with a competent accountant will help you calculate your QBI deduction and determine if you are eligible.

Quick warning: This section will explore some numbers and equations. Computing your qualified business income deduction is just as confusing as it sounds. But understanding it can help you determine whether you qualify for this opportunity.

Calculate Your Qualified Business Income

The first step is calculating the amount of qualified business income you generate from any of your U.S. trades or businesses. Be sure to reference our list of what is not QBI.

Understand the Income Thresholds

After you find your total qualified business income, you'll need to determine if the taxable income meets the threshold. If filing your taxes in early 2020, those thresholds were:

- Below the threshold limitation ($160,700 for single filers or $321,400 for married filing jointly)

- Is within the limitations phase-in range (between $160,700 and $210,700 for single or between $321,400 and $421,400 for married filing jointly)

The "bracket" under which your qualified business income falls will indicate your eligibility for the QBI deduction.

Suppose you're within the threshold limitation, great! There are no limitations, and you can claim the full 20% deduction. This deduction also applies even if your business is an SSTB.

What Happens If You're Over the Limit?

However, if your qualified business income deduction falls within the phase-in range, there are limitations. If you're an SSTB and within the threshold limitation, you can claim the full 20% deduction, the same as you would with a non-SSTB. But if it's within the phase-in limitation or above, you'll need to do some calculations.

You will need to calculate your deduction by taking 20% of your qualified business income of whichever is lesser:

More On Specified Service Trade or Businesses (SSTB)

As an SSTB, you want this deduction because of the savings potential. However, the IRS can make things difficult if you operate an SSTB. We'll illustrate a couple of points and provide a few examples to see if you qualify for the qualified business income deduction.

For the following scenarios, we'll use the 2018 QBI threshold amounts:

We will also use the 2018 phase-in limitation ranges:

Scenario A: Sarah

In 2018, Sarah's taxable income was $300,000. She's married filing jointly. Are there any SSTB implications, and are there any limitations?

No, there are no limitations on Sarah's QBI deduction. Since her taxable income is only $300,000, and the threshold amount is $35,000 for joint filers, she is not subject to any SSTB limitations.

As we mentioned earlier, Sarah must still deduct the lesser of:

- 50 percent of your share of W-2 wages paid by the business, or

- 25 percent of those wages, plus 2.5 percent of your share of qualified property

Scenario B: Jonathan

In 2018, Jonathan's taxable income was $170,000, and he is filing as single. He received qualified business income and is wondering if SSTB limitations apply.

Yes. Since Jonathan's income is $170,000 is above the threshold amount ($157,000 for single filers). However, SSTB limitations apply because his QBI is within the phase-in range.

Scenario C: Jane

In 2018, Jane's taxable income was $250,000. Her business is not an SSTB, and she is wondering if she can claim the QBI deduction.

No, Jane cannot claim the QBI deduction. Her taxable income exceeds both the threshold amount and phase-in limitation ranges.

How Do I Claim QBI Deduction?

For reporting a QBI deduction in 2018, the IRS did not offer a qualified business income deduction calculator. Taxpayers didn't have any specific forms to use either. Naturally, this made it difficult for taxpayers to compute their qualified business income and determine their eligibility. However, the IRS recommended Form 1040 for taxpayers with taxable income at or below the threshold amount.

Fortunately, the IRS added a qualified business income deduction form for the 2019 tax filing:

The IRS specifies that you can find these qualified business income deduction worksheets for 2020 in the instructions outlined in Form 1040 and Publication 535. Alternatively, you can access the Form 8995 PDF and Form 8995-A PDF online.

Let's Talk About Real Estate

Now, there may be some confusion surrounding real estate and the qualified business income deduction. We mentioned it briefly earlier, but now we want to dive into the topic a little deeper.

The rules surrounding the QBI and real estate income can feel ambiguous. Fortunately, the IRS released Revenue Procedure 2019-38, which "provides a safe harbor under which a rental real estate enterprise gets treated as a trade or business for purposes of section 199A of the Internal Revenue Code."

In other words, your real estate must meet the requirements of this safe harbor if you intend to claim the QBI deduction.

The IRS defines a rental real estate enterprise as "an interest in real property held for the production of rents and may consist of an interest in a single property or interests in multiple properties."

You must meet the following requirements to qualify for Safe Harbor and claim the QBI deduction:

What Are Rental Services?

We know what you're probably thinking.

The IRS is making this complicated with all this language about hours and rental services.

To start, what does the IRS even consider as rental services?

According to the IRS, rental services may include:

Fortunately, the IRS doesn't require that you, specifically, perform the services. You may document services and hours that your employees and contracts complete.

Maximizing Your QBI Deduction

Ideally, you'll want to keep your qualified business income within the income threshold. Exceed it, and you subject yourself to additional work and computations. Generally, here are some tips you might want to use to use your QBI to save you money (and headaches).

Paul Chaney, a staff writer for Small Business Trends, recommends employing the following tips:

Chaney also recommends that you consult with your CPA or tax preparer. Their expertise may offer additional insight or advice on applying your qualified business income deduction.

Choosing the Right Business Accountant

This guide on qualified business income is extensive and can feel overwhelming. Fortunately, you don't need to handle all of this by yourself. Instead, you can leave the number crunching, SSTB restrictions, and safe harbor requirements to your accountant.

But if you've been doing your taxes all by your lonesome, you may not know where to start. While an accountant may be costly, it is often worth the investment because they can save you so much more.

When searching for a business accountant that's right for you and your business needs, consider the following:

Qualified Business Income and Deducting Business Expenses

If you claim the 20% qualified business income deduction, can you still deduct your business expenses as usual?

The answer: yes, you can!

"Business owners can take the deduction in addition to the ordinarily allowable business expense deductions," said Paul Chaney with Small Business Trends.

Lower Your Taxable Income with These 16 Deductible Business Expenses

A tax deduction, or "tax write-off," is a business expense that you can deduct from your taxable income. The combination of the QBI, along with your business expenses, can significantly reduce your tax burdens. If you discover that you're just above the threshold for the qualified business income? Your tax write-offs can lower that ceiling and hopefully land you in that sweet spot.

Alongside claiming your qualified business income deduction, check to see if you can claim any of the following small business tax deductions:

#1 Business Use Of Your Car

If you operate a vehicle for your business, you can potentially deduct the entire cost of operating that vehicle. However, be careful. Claiming your car's full cost is a red flag for the IRS.

If you're using that vehicle for both business and personal use, you only want to deduct business-related costs. You can apply this deduction via:

As with anything with the IRS, you'll want to keep meticulous records. That may include an app to track your mileage, your business calendar, and receipts.

#2 Salaries And Benefits

Believe it or not, you can classify salaries, commissions, wages, and even bonuses as tax-deductible expenses.

However, there are some limitations. For example, the IRS requires that compensation be "ordinary and necessary" and "reasonable in amount." If you decide to claim this business expense, it's best to run it by an accountant first.

#3 Small Business Software

Software is changing how entrepreneurs conduct businesses. With payment processors, like Stripe, you can accept online, off-line, and contactless payments. With payroll software, you can complete payroll and administer benefits.

However, the cost of software can add up. Lucky for you, the IRS lets you deduct your monthly software subscription fees.

#4 Work Opportunity Tax Credit

This tax credit incentivizes business owners to hire from targeted groups. These groups are generally individuals who have "consistently faced significant barriers to employment." Some groups this tax credit targets can include:

For more information on taking advantage of this tax credit, check out the IRS website.

#5 Depreciation

While you may automatically assign a negative connotation to depreciation, it can be beneficial for a business. At least, from a tax perspective.

Depreciating business assets include equipment, machinery, office furniture, and electronics.

Calculating depreciation generally includes adding the asset's original cost and its costs to acquire and transport it. Then you would subtract the "depreciating" value from the total cost and divide it over the asset's lifetime. You can then take this calculation and deduct it each year.

Here's an example.

Let's say you purchased machinery for $10,000. It has a lifespan of 10 years and a depreciating value of $1,000. Subtract $1,000 from $10,000 and you have $9.000. You then divide $9,000 over ten years and arrive at $900.

This means you can deduct $900 on your tax returns over ten years.

#6 Advertising And Promotion

Marketing and business go hand in hand. Thankfully, you can deduct expenses related to advertising and promoting your business. Deductions for marketing-related costs may include:

#7 Bank Fees and Processing Fees

On your list of business deductions, you can add bank and card processing fees.

Depending on your business bank account, they can charge you monthly service charges, overdraft penalties, and other fees.

You can also apply this deduction to third-party payment processors. Point-of-sale systems, like Square or Shopify Pay, charge a percentage of the transaction plus a fixed fee.

#8 Travel Expenses

Here's how the IRS defines deductible travel expenses:

"Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes."

The IRS also specifies that you cannot deduct travel expenses for locations you expect to work for more than one year.

With that in mind, here are some travel expenses you can potentially deduct:

#9 Legal And Professional Fees

It may be possible to deduct fees you pay to service professionals, including:

If you have a bookkeeping professional manage your business finances monthly, you may also be able to deduct their fees.

Of course, this relates only to business-related consultations. Therefore, you can't deduct fees associated with financial advice on your retirement planning.

#10 Business Insurance

Undoubtedly, business insurance will be one of your highest expenses when starting and running your business. Fortunately, the IRS lets you write off some of your business insurance expenses in your tax return. This may include:

#11 Education

Those that keep their knowledge up-to-date and stay innovative are the businesses that remain competitive. Fortunately, business-related education costs may be deductible. Some education expenses can include:

#12 Home Office

If you meet the requirements, you can deduct a percentage of your home used solely for business use. According to Fiducial, your home office must meet the following criteria:

Also, there are two methods you can use when deducting your home-office: actual expense method or simplified method. "The actual-expense method prorates home expenses based on the portion of the home that qualifies as a home office, which is generally based on square footage," Fiducial explains.

The simplified method is often more approachable. You can deduct $5 per square feet of the home you use for the business. The maximum you can claim is 300 feet for a $1,500 home office deduction.

There are advantages to using one or the other. The simplified method is straightforward but with a 300 square feet limitation. That restriction does not apply to the actual-expense method.

The requirements for deducting a home office can be tricky. We recommend that you refer to Publication 587 for more information. Otherwise, you may expose yourself to a nasty IRS audit!

#13 Business Meals

Imagine taking a client to dinner and not having that meal subject to federal taxes? The IRS allows you to deduct qualifying business meals.

This deduction was much easier in the past. The Tax Cuts and Jobs Act under President Trump introduced additional regulations. If you decide to claim this deduction, we recommend that you review the updated guidelines.

#14 Interest

Are you a brand new entrepreneur? If you don't have the cash reserves for bootstrapping, you may need to seek startup financing. This may include a traditional business loan, an SBA loan, or a business line of credit. Fortunately, the interest you generate on your business loan is tax-deductible.

Naturally, you must use your business loan for business-related expenses, such as:

Also, you must be legally liable for the debt. That means it's YOUR name on the business loan and not your grandfather who secured the loan and sends you some money. Monetary gifts through grants and angel investors may not be applicable.

#15 Rent Expense

Ecommerce is booming, but a traditional brick-and-mortar business might be your pathway. The IRS allows you to deduct rent if you're using that location solely for your business. However, please note that rent is not tax-deductible if you receive equity in the property.

#16 Telephone And Internet Expenses

Undoubtedly, wi-fi is a necessity in today's business climate. Fortunately, the IRS lets you claim telephone and internet services as a deductible business expense. If you're claiming your cell phone, we recommend keeping detailed records that prove you use it for business use.

Another note for home offices: you cannot claim a home landline if you don't use it solely for work. You may need to open a second landline dedicated to business purposes if you want to claim it as a deductible business expense.

Do I Need To Be Active To Qualify For QBI deduction?

Interestingly, no. The IRS states that eligible taxpayers may claim the qualified business income deduction "regardless of their involvement in the trade or business."

Therefore, income from businesses that you don't actively manage may still qualify as QBI.

Is Qualified Business Income An Itemized Deduction?

According to the IRS, you can claim the qualified business income deduction "regardless of whether taxpayers itemize deductions on Schedule A or take the standard deduction."

That means that you don't need to worry about filing your taxes via itemized or deduction. The qualified business income deduction can apply to either method on your tax filings.

Final Thoughts

The rules surrounding the qualified business income deduction can be confusing. Just like the IRS tax code, the QBI is complex and subject to changes for inflation annually.

However, the QBI deduction is something you should seriously consider. A 20% deduction is incredible and can keep more money in your pocket. Even if you're an SSTB, you may still qualify for this deduction.

Don't rely on your own research. It can be worth the investment to hire a financial professional. Certified accountants are generally more knowledgeable on tax policies, and the right expert can maximize your savings.

We talk a lot about taxes inside The One Percent community. It’s the best place for entrepreneurs to find the resources, training, and connections they need to build a thriving business, invest the profits, and create change in the world. If you’re tired of going it alone and eager to collaborate in a give-first community, come check us out. We’re ready to welcome you!