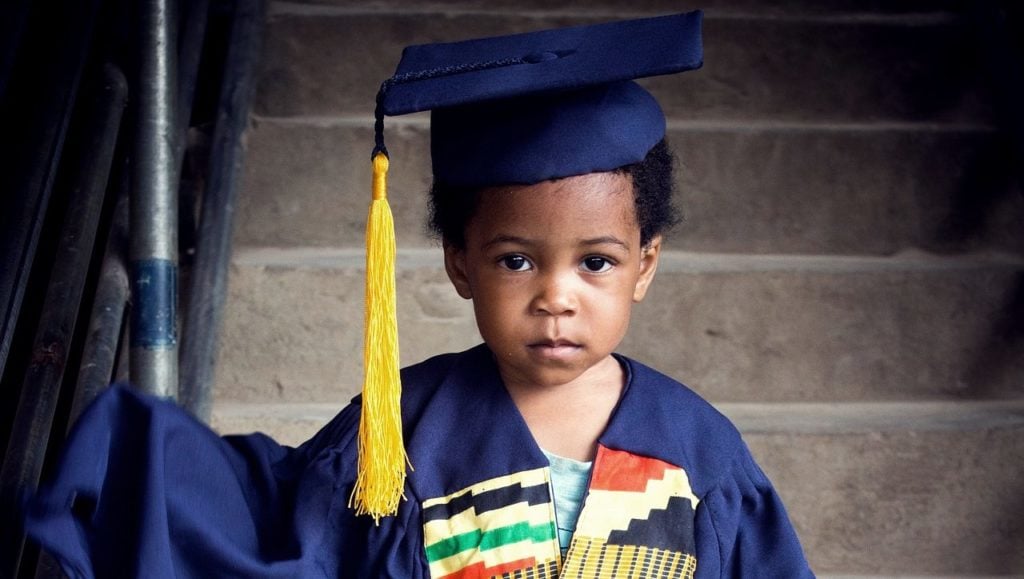

A college degree is often considered as the premier path toward opportunities to experience upward mobility in our nation's economy. Will it be worth it for your children, though?

A new projection of the total cost of a 4-year degree might have you think twice on that.

According to Credit.com's Karen Price Mueller, the cost to send your children will exceed an exorbitant $500,000 for all four years.

Mueller enlisted the help of certified financial planner Matthew DeFelice of U.S. Financial Services to lay out the potential cost and how much a parent should consider saving, using the concept of having a newborn in the family as an example.

To pay, in full, for your child's college education, would require saving $1,231 per month, or $14,775 per year, for the next 18 years of your child's adolescence. DeFelice projected this based on a zero balance in a 529 College Savings account.

Granted, the $500,000 total is a general estimation. The exact numbers for some specific universities are still very eye-opening. The College Board recently reported on current college tuition averages, stating that a "moderate" tuition for a private university averaged nearly $50,000 per year, while in-state public college averaged just under $30,000 per year.

DeFelice projects that in 2037, exactly, the cost to attend a public university, like Rutgers, could cost $463,812—with tuition and room and board for all four years considered. Private schools, like Princeton, could be as much as $611,641 in all.

“My personal feeling is that something needs to be done about the skyrocketing cost of education in this country, but that is an argument for another day,” DeFelice told Mueller via the Credit.com analysis.

Some recommendations that were given included parents—and grandparents—spreading the costs among themselves with their child in order to pay for college as best they possibly can.

However, college savings accounts still remain as the most market-friendly way to save and pay for college, based on the current state of the economy.

This projection comes in lieu of a multi-billion dollar student loan crisis that will continue to compound and grow, exponentially, if this projection is true.

Do you believe this projection? Leave a reply in the comments and let us know.

MORE FINANCIAL BREAKDOWN AND ANALYSIS ON CAPITALISM.COM

• 3 Key Steps to Strengthen a Business Loan Application

• How to Properly Use Debt to Build Wealth

• Business Basics: How to Build – and Understand – a Profit-Loss Statement