Whether the oil crash is giving you nightmares, leaving you itching to invest, or drawing your attention in the sick way humans often can’t look away from a disaster unfolding in front of them, you’ll enjoy this piece by Sean Ring, CAIA, CMT, FRM.

Disclaimer: We’re just playing with ideas, talking about a popular topic among entrepreneurs. This post is absolutely NOT meant to be investing advice. We’re just idiots on the internet, so you should definitely not base investing decisions on anything we mutter.

“There I was, having a rather nondescript day on my trading desk, when the phone rang. I picked it up, thinking not much of anything. Then I heard a question that turned my guts to water.

"Seanie, where would you like your oil delivered to?"

Of course, I was thinking, "What oil, and why would I want any oil delivered to me?"

Then I meekly asked, "What oil are you talking about?"

He said, "Well, your client's long one futures contract of the WTI (West Texas Intermediate). Where do you want us to deliver your oil?"

At that moment, I felt a hot patch on the back of my neck heat up... that always happens when I screw up. Utterly confused, I had a face like a beaten favorite.

Then, visions of a full oil tanker gliding up the Thames to my office nearly set my bowels loose. My eyes in Clockwork Orange mode. With my jaw unceremoniously resting on the floor, I was standing there frozen as a cigar store Indian. I quickly said, "I'll call you right back!" as I slammed down the phone.

I tried to figure out what was going on.

You see, I was a financial futures broker. Those contracts are usually cash-settled. (Except for bond futures, but that’s another embarrassing story for another time.)

How did this happen? One day my client’s usual commodities broker was off sick, so I bought one measly oil futures contract for him - a couple of keystrokes, and it’s all done. No fuss, no muss. Or so I thought.

Except one WTI futures contract’s size is 1,000 barrels, unbeknownst to me in my youthful ignorance.

What I came to realize in that butt-clenchingly stressful moment was that oil was physically delivered. Not cash-settled like financial futures contracts are. So I had to call my client up and tell them that they were still long that WTI contract… and it was maturing tomorrow!

"Hey! I don’t have a warehouse available. Can we please close out this position, so I don't have to take 1,000 barrels of oil in my London office?"

The client laughed at me and sold right away. Thankfully there was some liquidity still in the market.

Then, I was one dopey junior futures broker. Now imagine how those guys felt on Tuesday…

Why is an oil crash hitting now?

Well, two simultaneous shocks are happening.

The first was a supply shock. Saudi Arabia and Russia had a massive disagreement over oil prices. To get the advantage, the Saudis ramped up its production, taking $8 to $9 off the price of oil.

Russia followed suit and wound up losing quite a bit of money. Russia depends on oil and gas revenue far more than they should.

The Saudis have close to USD 500 billion in reserves, so they could weather the storm a bit more. And quite frankly, both of them were happy that US shale oil companies were probably going to go bankrupt.

What they didn't foresee was the massive and overriding demand shock COVID-19 caused.

The problem with COVID-19 is that everyone's quarantined. Nobody is filling up their gas tanks. Governments have shut down industrial production. So there is far more oil in the world than anyone needs at the moment. It’s honest to call this a government-mandated shutdown of the private sector. (Should the government bail us out?)

And where’s OPEC been in all this? How does OPEC control the price of oil? We’ve just seen that the cartel doesn’t nearly have the sway it once did. Saudi Arabia and Russia (who’s not part of the cartel) have demonstrated that.

So who controls or decides the oil prices? Ultimately, it’s supply and demand in the market. The consumer is still sovereign. And since the consumer is forced to stay at home watching Netflix, there is no demand at the moment.

Is it smart to invest in oil?

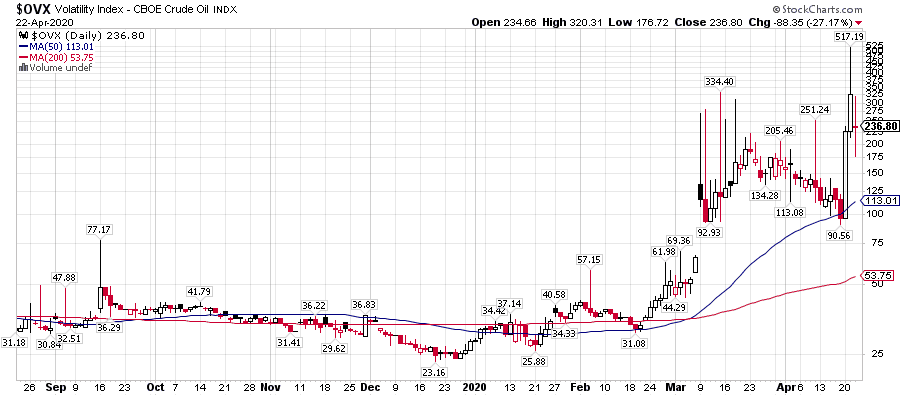

Probably not. Volatility in the oil market topped out at 517% intraday. Not 5.17%. Not 51.7%. But 517%. It is an absurd number, unforeseen by any analysts, and not seen before in the market. That’s why they're calling the WTI contract the “WTF?” contract. Volatility is sitting at a still-cringe-inducing level of 236%.

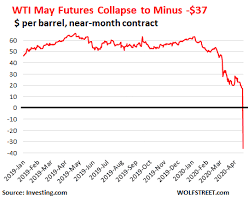

The other crazy thing is we don't know where the bottom is. That’s because oil futures actually closed out at a negative number for the first time. (You even had some young politician who “absolutely loved to see it.”)

The Chicago Mercantile Exchange is going to allow negative strike prices on oil options. No one ever thought they’d see that...

So for all you who are trying to try to buy at the bottom: You can't actually buy at the bottom if it's a bottomless pit. That is, there’s no guarantee this can’t happen to the June contract as well.

What oil stocks dropped the most?

A bunch got crushed in the market. They are W&T Offshore, Halliburton, Baker Hughes, Core Laboratories, and Helmerich & Payne (See the second chart). They’re all down over 45%. Exxon Mobil, Chevron, and the other integrated oil companies are also hurting, but not as bad as those five.

Here’s how the Top 10 Oil Integrated Majors fared since the beginning of the year:

If you think that’s uglier than a blind carpenter’s thumb, try these:

How can I invest in oil with little money?

Well, the question, first is, can you get it delivered? Do you own a warehouse? Or do you have oil storage space in Cushing, Oklahoma?

It's a terrifying thing right now to be caught long oil, without actually being able to take delivery of it.

So we don't recommend buying any physical oil at the moment, that’s for sure. And that goes for any oil futures, as the volatility will sling you straight into the poorhouse. That's thanks to all the leverage embedded into those contracts. (And most retail investors can't buy oil futures contracts anyway.)

As for oil companies, it's dangerous to invest right now. According to Bryce Coward, CFA of Knowledge Leaders Capital, two-thirds of US oil and gas companies may not exist a year from now.

So if you get this wrong, you may be owning a company that goes bankrupt, let alone doesn't pay you a dividend. So consider the credit risk of these companies very carefully.

Snake Oil Alert!

It's critical not to invest in USO, which is the US Oil Fund.

The reason why you don't want to invest in USO is that it doesn’t track the price of oil. The way it tries to track US oil prices is by buying oil futures contracts.

What that means is instead of buying the underlying physical oil itself, it will buy the futures.

Contango? It sounds like a dance move...

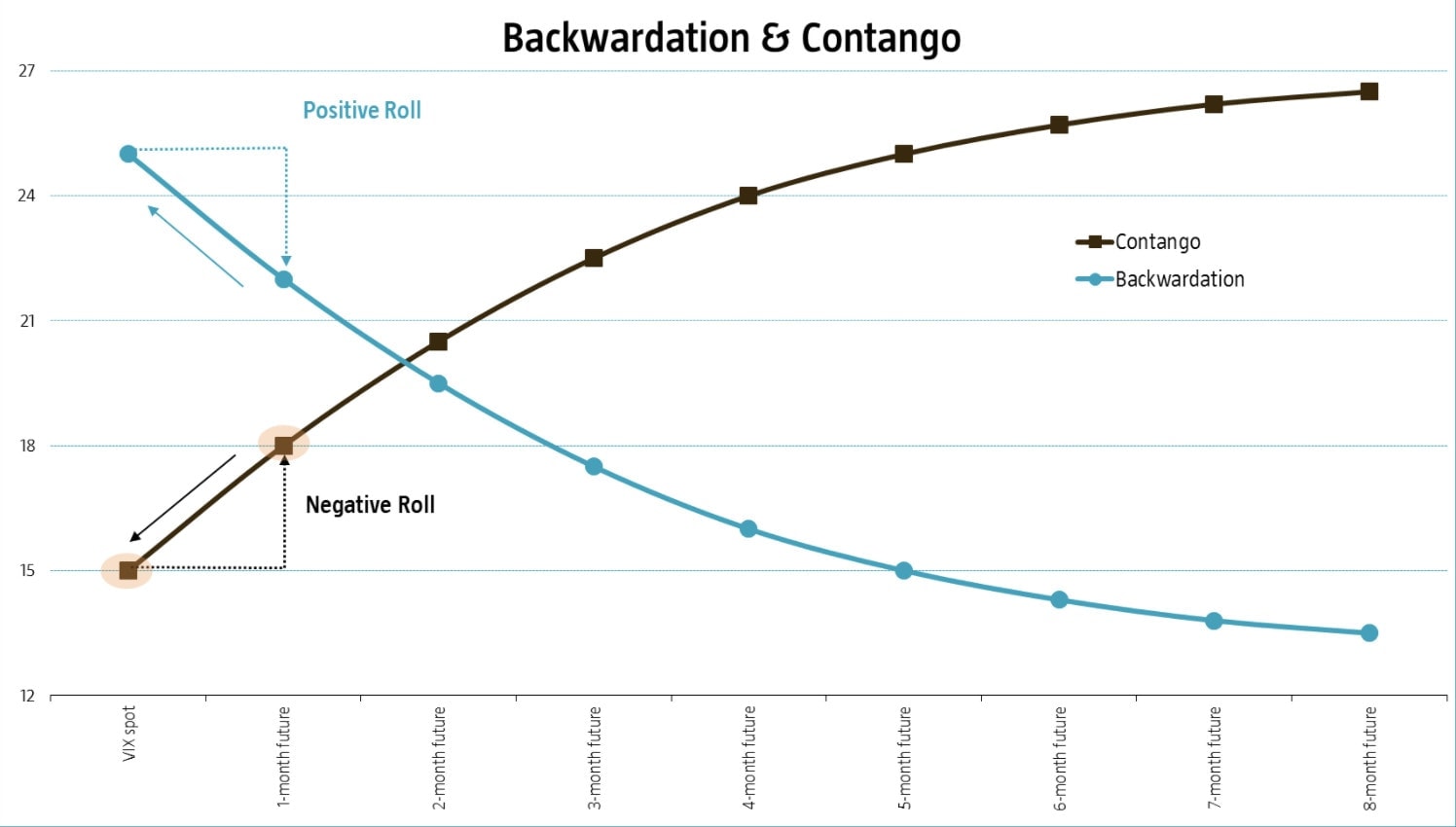

Now, two terms we need to know. Contango and backwardation. Contango means that you have an upward sloping curve. That means the spot price of oil is less expensive than the futures contracts after it on the strip. Spot price means the price of a physical barrel right now. Then you have the June futures contract, the July futures contract, and the August futures contract... and each successive contract is more expensive than the next one.

No, not backdating… backwardation.

Backwardation means each successive contract is priced lower than the previous one. (See chart above.)

Now, the problem is, oil is usually in a contango market. So, when you invest in USO, you're not tracking the price of oil, you're getting killed on the roll yield. Every time a month rolls down the curve to maturity, you're selling that cheap contract... and buying a more expensive contract to replace it. That’s called a negative roll and in the picture.

99% of retail investors have no idea that occurs. That's why they wonder why they're not making as much money on oil as they should be. CNBC published this article in 2016, calling USO a snake oil contract. If CNBC can't be your cheerleader, nobody can. So please do not buy the USO ETF, or in fact, any ETF that purports to track the oil price.

Don't be like these retail investors on Robinhood!

Is oil a good investment?

Well, what do you do when oil is practically free?

What most people would do is store as much as they can and hope at some point in the future, they could sell it for a lot more. But unfortunately, everybody who knows anything about oil is trying the same idea.

What that means is that the world's storage capacity is used up. This accounts for the negative prices in the May oil futures contract.

Sellers, producers of oil, were actually paying buyers to take the oil off their hands!

That’s like walking into a 7-11, asking for a can of Coke, and the teller going, "Well, here is your can of Coke and take $10. Thank you so much for letting us get rid of our inventory."

It's an incredible, unprecedented situation. So it's an hazardous situation for any investor to enter.

So if you don't have a supertanker already, or some space at Cushing, buying oil is not for you.

What is the best oil company to invest in?

If you absolutely must take a risk, the safest stocks right now are the integrated majors.

As Kenny Rogers once sang, “You’ve got to know when to hold ‘em, know to fold ‘em, know when to walk away, know when to run.”

Enjoy Investing Conversations?

If you’re an entrepreneur who’s ready to learn how to invest the profits from your business, you don’t have to learn the hard way. You sure don’t have to do it alone. We recommend joining The One Percent community, where entrepreneurs create wealth and passive income. Check it out and join us!