If you want to get serious about your future and hopefully achieve financial independence, you can't afford to ignore the stock markets. It's a form of building a passive income that makes your money work for you.

Let's say you invest $10,000 at a 6% annual return. Assuming that all conditions stay the same, you can transform that $10,000 into nearly $18,000 over ten years. And that's WITHOUT additional contributions over time.

Insane, right?!

That's the power of compounding.

But stocks come in so many shapes and sizes. There are different companies, industries, and dividend yields to consider.

What should you choose? In this article, we're diving into monthly dividend stocks. What are they? Why should you invest in them? And how come entrepreneurs LOVE them!

What Are Monthly Dividend Stocks?

Before we explore monthly dividend stocks, let's dive into some basics.

A stock is an investment that represents your ownership share in a company. When you buy a stock in the stock market, you're purchasing a small piece of that company. Companies sell you stock, and in return, they issue you payments over time. This payment is a dividend, and it's one way investors make money by investing in stock shares. (The other way is capital gains, buying stock you sell once it increases in value.)

Most companies pay dividends quarterly or annually. But there are some companies out there that they pay their dividends monthly. But does it really matter when or how often a company pays its dividends? In some cases, paying monthly dividends has some unique advantages. Here are a few!

3 Reasons Why Stocks that Pay Monthly Dividends Are AWESOME!

#1 Steadier Income

As we learned, most companies pay dividends on a quarterly or annual schedule. One reason why monthly dividends are attractive is that they better align with your lifestyle. You typically pay your mortgage, utilities, and subscriptions monthly.

If you intend to live off the payments from your dividend yields, then a monthly dividend payment makes the most sense. We do, however, recommend that you reinvest as much of the profits as possible. This will allow for faster growth.

#2 Faster Potential Growth

As we mentioned, we recommend that you wisely reinvest all the dividend payments you earn for one reason:

Compounding value.

If you've been investing for any amount of time, you've likely stumbled across this term. And it's the reason why investing is often a long-term game. Compounding value allows your initial investment AND earnings to work for you.

When you invest in one company that pays only annually, you potentially profit only from your initial investment. So, if you invest $100,000, your return percentage is based only on that amount.

Investing in a company that pays monthly, it works a little differently. If you invest $100,000 and then invest your monthly dividends back into the stock market, you can potentially gain returns from your initial investments and dividend payments.

When you reinvest your dividends, you give it time to compound and grow in value over time. Imagine what earnings you can reap if you followed this concept over two years, five years, two decades?

Monthly dividend stocks can be a lucrative investment if you do the proper research.

#3 Greater Flexibility When Selling

You'll often hear of investors holding onto a stock until they receive their dividend payment, even if market conditions urge you to sell. Since monthly dividends pay out monthly, you feel less compelled to hold onto a stock until you get paid. There's no need to wait months to sell a stock so that you can receive your payment. If the stock becomes too risky to hold onto or if you need to liquidate quickly, monthly dividend stocks offer greater flexibility.

Are Monthly Dividends Better Than Quarterly?

It's difficult to say whether one type of stock is better or worse than the other. As we mentioned in the benefits above, monthly dividend payouts do have their advantages. But would one be exponentially better than the other?

Probably not.

If you get hung up on this "debate," you are actually doing yourself a disservice:

- You close yourself off to opportunities granted by other types of stocks

- You're training your investing mind to focus on less important things

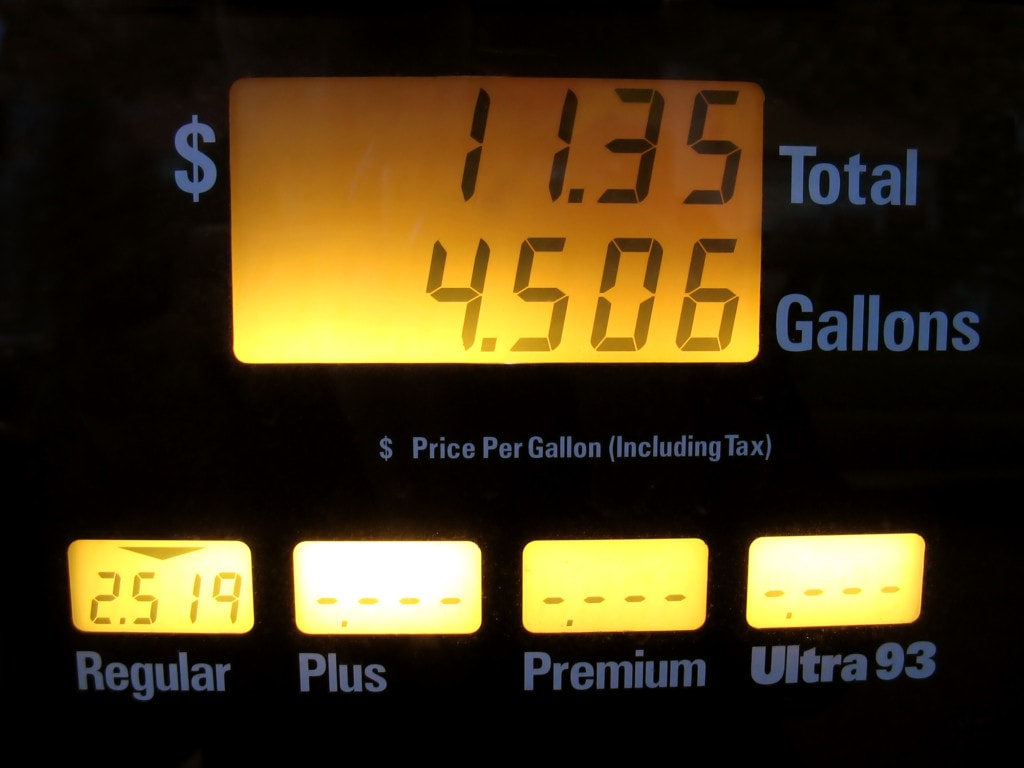

There are other critical factors to consider that will affect your profitability over the long-term. Investing in an oil company stock that pays annually, for example, can yield higher returns. This industry, however, is extremely volatile. Pay attention to the industry as well as when dividend payments are paid. The dividend payment frequency alone isn't enough to judge the quality of a stock investment.

With that said, feel free to include companies that pay dividends monthly, quarterly, and annually. If you think that monthly dividends are superior but find a reliable company you believe in, but they pay quarterly, feel free to invest in that company.

What Are Some Good Dividend Stocks? What to Look Out For

Your confidence as an investor will encourage you to look at a wide range of factors, including:

- Industry. What type of industry is the company operating within? Is it volatile with high risk? Are you willing to exercise that high risk in hopes of a high return on investment?

- Does the company have a competitive advantage? Like a unique brand, business model, leveraging new technology, or delivering an exciting product?

- The company's board of directors. What is their business experience? Are there members outside the company that can objectively assess the company's trajectory?

Your goal should always be to be an informed investor. While we shared some benefits of monthly dividend stocks, here are some things to watch out for as well...

What to Watch Out for With Monthly Dividend Stocks

Cutting Dividend Payments During a Recession

Companies that issue monthly dividend payments have more deadlines to meet when paying their shareholders. This can be challenging, especially in an economy that goes sour. Investors are expecting to receive their monthly dividends. If a company goes belly-up or is struggling, they may need to cut monthly dividend payments to stay afloat.

High Payout Ratios

A high payout ratio can help you judge whether a company's dividend payment stream is sustainable. You can calculate it by dividing the dividends per share by the earnings per share.

A high payout ratio isn't always a negative thing. It can indicate whether their profits go back into the company to encourage more growth or pay out to investors.

Many investors prefer stocks with lower payout ratios because they can more often afford dividends during an economic dip. Our preference is a payout ratio no higher than 75%.

What is the Best Monthly Dividend Stock?

What is the Highest Dividend Yielding Stock?

Have monthly dividend stocks piqued your interest? If you're itching to add the top monthly dividend stocks 2020 to your portfolio, here are some stock options to consider:

What Companies Pay Out the Highest Dividends?

Here are some of the best monthly dividend stocks 2020 with a couple of recommendations by Yahoo! Finance:

- AGNC Investment (AGNC) Dividend Yield: 11.27%

- Shaw Communications (SJR) Dividend Yield: 5.59%

- EPR Properties (EPR) Dividend Yield: 17.02%

- Stellus Capital Investment Corp (SCM) Dividend Yield: 19.70%

- Solar Senior Capital (SUNS) Dividend Yield: 9.43%

Monthly Dividend Stocks Under $10

- Stellus Capital Investment (SCM) Dividend Yield: 20.29%

- Prospect Capital (PSEC) Dividend Yield: 18.00%

- Whitestone REIT (WSR) Dividend Yield: 7.07%

- Cross Timbers Royalty Trust (CRT) Dividend Yield: 15.27%

Monthly Dividend Stocks Under $5

Capitala Finance (CPTA) Dividend Yield: 35.57%

Monthly Dividend Stocks on Robinhood

Robinhood is a trading platform that makes it easy for beginner investors to get started. With enough research, it's possible to find even monthly dividend stocks under $2. Here are some monthly dividends examples you can expect to find on Robinhood:

- Realty Income Corp (O) Dividend Yield: 5.37%

- LTC Properties (LTC) Dividend Yield: 6.61%

Which Oil Company Pays the Highest Dividend?

Before answering this question, we encourage you to arm yourself with knowledge about the oil industry. This highly volatile industry carries certain risks that you should be mindful of before purchasing a stock:

Risk of Commodity Price Volatility

The oil industry is fraught with risks that increase the stock's volatility. This industry is especially vulnerable to supply and demand. Any shift in either direction can lead to significant fluctuations in the underlying stock's value. There is a high probability that commodity price changes will result in losses for investors.

Cutting of Dividend Payments

Due to the price volatility of oil stocks, there is a risk that companies will cut dividend payments. If there is an economic downturn, oil companies can be severely affected. If a company is unable to earn enough revenue, it may not be able to issue dividend payments to its stockholders.

One example was when Seadrill, an operator of drilling rigs cut dividend payments in November 2014. Investors rushed to sell their stock, causing Seadrill's shares to drop 23%.

That was six years ago. Let's look at what's happening today with the recent coronavirus pandemic.

Equinor, a petroleum refining company, headquartered in Norway, recently announced that it "cut its quarterly dividend payment to shareholders by two-thirds." The next pay-out to shareholders will be $0.09 per share, a 67% reduction from its last 2019 pay-out of $0.27.

Other gas companies are following suit. Royal Dutch Shell, a company famous for maintaining its dividend since World War II, just slashed its dividends from $0.47 to now $0.16 per share. The company is struggling and experienced a $24 million net loss for the first quarter of 2020.

Legal and Regulatory Risks

The legal and regulatory risks mentioned above tie in with the above points. Oil companies face challenges unique to their industry. One potential problem is the possibility of an oil spill or an accident. An oil company has the potential to negatively impact the environment if it doesn't have the necessary structures and protections in place. If an oil company harms marine life or other habitats reaches the news, its share price can plummet.

Coronavirus Knocked the Oil Industry on its Side

Earlier, we listed examples of how the oil and gas industry is sensitive to global events. But let's take a more in-depth look at why and how the coronavirus outbreak is wrecking this industry. As an example of how the oil industry is sensitive to global events, let's look at the effects of the recent coronavirus outbreak.

Since many businesses are closed and many employees don't have to commute, the need for transportation and fuel has significantly decreased. Oil production around the world has exceeded demand by wide margins. Oil companies are suffering, and some, like Whiting Petroleum, have even filed for bankruptcy.

The coronavirus outbreak is a unique situation. But it shows how the oil industry is vulnerable to such current events.

Oil Companies to Consider Investing In

Still, oil companies can be worthwhile investments due to their higher dividend yield. This acts as an enticing incentive for investors to buy an oil stock. Investors will likely experience high returns during economic booms that are favorable to the industry. Of course, they also risk not receiving a dividend payout during an economic downturn.

Still, there are companies within the oil industry that have the financial strength and contingency plans to help carry them through rough patches.

If you're still interested in taking on the risk of investing in oil companies, it's important to note that most pay their yields annually or quarterly. Here are a few top picks from Dividend.com.

- Total SA (TOT) Dividend Yield: 8.34%

- Equinor ASA (EQNR) Dividend Yield: 7.84%

- EQT Midstream Partners LP (EQM) Dividend Yield: 7.81%

What is BP Dividend Yield?

BP plc (formerly The British Petroleum Company plc and BP Amoco plc) is an oil gas company headquartered in London, United Kingdom. It is one of the top-yielding stocks and has risen to the top as one of the best performers within the industry.

BP plc is often known for paying a significant portion of its cash flow to its shareholders. According to The Motley Fool, the company generated $24.1 billion in cash and paid out nearly $6.3 billion in dividends. For this reason, many investors interested in investing in oil companies are quick to research this.

But how is BP faring during current economic conditions?

Yahoo! Finance reports the BP plc's forward dividend and yield at 2.52 (10.72%). Coronavirus hit the oil and gas industry hard — BP is no exception. According to Forbes, BP plc's profits dived 67%. Even so, BP is committed to its shareholders and maintained its dividend.

"Our industry has been hit by supply and demand shocks on a scale never seen before," says BP's new Chief Executive Bernard Looney, "but that is no excuse to turn inward. We are focusing our efforts on protecting our people, supporting our communities, and strengthening our finances."

This leaves investors hopeful, and many believe BP will bounce back and are seeing this as an opportunity to invest in the company.

Like many oil giants, BP plc hasn't been performing so well. Over the weeks, it has dropped by nearly 20%. Still, many investors believe that the company will bounce back. They see this as an opportunity to invest in the company.

As you build your financial knowledge and gain more experience investing, you'll begin to spot opportunities like this. Part of the fun of investing is making informed and educated gambles about how a stock will perform in the future.

Why is IPO Done?

In the world of investing, there's something known as an Initial Public Offering (IPO). And a helpful way to think of it is that an IPO is the Hollywood movie premiere before it's shown to the general public.

An IPO is the first time a company issues stock to the public. And companies often offer an IPO as a way to raise capital for growth and expansion.

Let's look at an example:

Jane owns a chain of successful cupcake bakeries in Texas. She feels she's ready to expand her chain to other states. She decides it's time to issue shares to the public to help her raise money for this business goal. This capital will help her rent new locations, secure inventory, hire staff, and more.

She issues stocks through an investment bank. Together, they determine the IPO price, the number of shares they'll issue, and the percentage of ownership she wants to give out.

Let's say Jane's cupcake company is worth $100 million and wants to sell 10% of her company. She has the potential to raise $10 million, which is 10% of her company's value.

And with that, the investment bank decides that they will issue one million shares to the public at $10 per share. They arrange a date that the IPO will be available, and when the general public can start buying shares.

IPOs and Monthly Dividends

IPOs are an excellent opportunity for companies to grow rapidly. Just keep in mind the things we mentioned earlier that you should be watchful of:

- High payout ratios

- Risk of not being able to pay dividends during a ratio

Be sure to do your research and speculate how a company will fare under current market conditions. Then make an informed prediction of how they will perform over time. There are a few ways you can do this:

One way is to review the company's financial statements. Companies must file with the U.S. Securities and Exchange Commission certain documents. One of them is the Form 10-K, which is an annual report with critical financial statements that are independently audited. Another is the Form 10-Q, which is a quarterly update on operations and financial results. Reviewing this document will give you a general sense of the company's financial health.

You'll also want to look up from the numbers and assess the company itself. Does the company have a competitive advantage that can distinguish itself from the noise? What does their brand look like? Is there a market demand for their product?

Also, research the company's board of directors. What is each members' business experience? Are all members of the company? Or are there members outside the company that can objectively assess the company's performance?

Final Words

Monthly dividend stocks are just one benefit that makes investing such an exciting financial venture. With monthly dividend stocks, you have access to steadier growth. Also, you see greater potential for compounding growth and more flexibility when it comes to selling.

We hope that this article has deepened your knowledge of investing. Hopefully, it inspired an idea or two of which monthly dividend stock you'll be adding next to your investment portfolio!

If you’re in the process of educating yourself about investing, you should check out this free video training we just made for you. It’s all about building a business of your own and investing the profits so you can become financially free sooner than later.

Disclaimer: At Capitalism.com, we do our best to provide accurate information on finance and investing. But we are NOT certified financial or legal professionals. Investing is not a one-size-fits-all, and the advice presented here may not apply to your unique situation. We do NOT guarantee that any of the advice will result in you getting filthy rich (we still have yet to crack the secret code to unlimited riches). We recommend that you use this article as a starting point. Do your own research and due diligence, which may include consulting with a qualified financial professional.