“The story of rising inequality, therefore, is not primarily about politics or rent-seeking, but rather about supply and demand.”

- N. Gregory Mankiw, Economist, Harvard University (2013)

Measures of U.S. household income inequality have been rising for the past four decades. This is a fact well-known to economists.

By Census Bureau estimates, two of the most widely cited measures used to gauge levels of income inequality, the Gini Index and the ratio of income shares of the top 20 percent to the bottom 20 percent, have increased by 21.3 percent and 63.4 percent, respectively, from their low in 1974 through 2015.

Virtually all other developed economies exhibit similar trends during this period.

The concerns over rising inequality expressed themselves in the recent contentious U.S. elections of 2016, arguably one of the main issues shaping political platforms in the presidential campaign. On the Progressive Left, the driving ideology is egalitarian equality of outcomes.

Progressives tend to view the economy as a zero-sum game where the gains to some (often viewed as a lucky roll of the dice) come at the expense of others; a fixed income pie, where a larger slice to some means a smaller slice to others. These critics of inequality decry what they see as social injustice, unfairness in outcomes, and a capitalist system rigged against the poor and downtrodden. Their policy proposals invariably include much greater levels of government income and wealth redistribution from “the rich” (bankers, CEOs, wealthy elites, etc.) to “the poor.”

On the Populist Right, the driving ideology seems to be an eclectic mix of cultural nationalism, nativism, trade protectionism, and xenophobia. Populist conservatives tend to blame global trade, “cheap foreign labor,” and immigrants (legal or illegal) for the rise in inequality and the stagnant real wages of the working and middle classes.

Their policy proposals often include some combination of tariff hikes and other restrictions on imports, greater restraints on both legal and illegal immigration (“building a wall”), and support for increased social safety nets accessible only to American citizens.

Ironically, the four-decade rise in income inequality in the United States and around the world is not a result of either social injustices or the nefarious influence of foreigners. Instead, most non-partisan economists have realized that rising inequality is a simple matter of supply and demand in labor markets, driven by underlying structural shifts resulting from technological advances.

Thus, both sets of arguments against income inequality, those from the Progressive Left and from the Populist Right, need to be dispelled.

Seen from an alternate perspective, income inequality in a capitalist or “mixed” economy like that of the United States may actually be a “fair” outcome, since it most frequently results from the inherent differences in productivity and wealth-creating abilities of those who serve their fellow man through voluntary, non-coercive trades.

Income inequality is not a “problem” to be solved, but a condition to be understood and accepted.

It is a natural feature of free markets, reflecting the differences people exhibit in their abilities and the differing valuation that others place upon their skills and creativity.

Of course, while markets are quite transparent in revealing this hierarchy of talent in the form of income differences, many people in those markets hate, despise, and resist those revelations. After all, if you are offering products or services that are perceived by your fellow consumers to be rather pedestrian or mediocre, you don’t like that pointed out to you in the form of a lower income relative to your more successful rivals or peers.

But, that is exactly what capitalist markets do each and every day. The outcomes of voluntary trade and competition are rarely equal (in terms of incomes received) because the productive abilities of the participants are rarely equal. Denial of this reality, often accompanied by enviousness of others, is what the economist Ludwig von Mises labeled “the anti-capitalistic mentality.”

Voluntary trade is not a zero-sum game, win-lose; it is a positive sum game, win-win. Voluntary trade creates wealth by improving the position of both parties to the trade. People do not trade unless they expect to be made better off.

The higher incomes earned by “the rich” are almost exclusively a reflection of the wealth they have helped to create for others in the form of valued goods and services; wealth that flows in the opposite direction toward others, including the poor, through the voluntary trades initiated by all in the marketplace, rich and poor alike.

Thus, the economic pie of a capitalist economy is not a fixed sum arbitrarily divided up, so that when one person gets a larger slice, someone else gets a smaller slice. This is the zero-sum fallacy. Instead, the wealth-creating outcomes of voluntary trade increase the overall size of the pie, so that the “slices” of wealth or income, regardless their absolute size, are all larger, since the pie itself is growing larger in response to the productive activities encouraged through the incentives of trade.

Redistribution of income and wealth, as both Progressives and Populists propose, will not and has not served to lessen income inequality. Redistribution merely dampens initiative and reduces investment in human capital and entrepreneurship. Incentives matter.

First, when people are permitted to keep only a reduced fraction of what they earn from their efforts in serving others, they are less likely to seek out opportunities to create wealth for their fellow man in the marketplace; less investment, less entrepreneurship, less innovation.

And, second, when people receive some basic income through entitlements without regard for the wealth they create for others, they are less motivated to invest in the kinds of skills, training, education, and experiences that will raise productivity in the marketplace, again the result being less investment, less entrepreneurship, and less innovation.

The reluctance of both parties affected by the coercive transfer of income to invest in wealth-creating activities lessens overall wealth and economic opportunity for all.

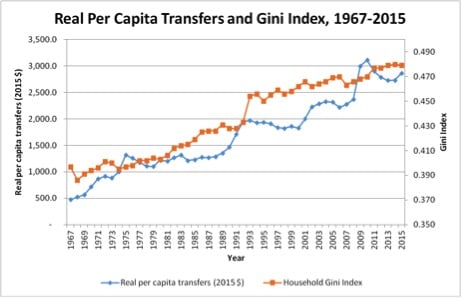

Trillions of dollars have been spent to reduce income inequality over the last half-century, but to no avail. In spite of rising transfer payments channeled through a host of means-tested programs, income inequality has continued to rise, perhaps in spite of these transfers, perhaps because of them.

According to Bureau of Economic Analysis and Census Bureau estimates, since 1950, total federal, state, and local government spending on poverty programs (excluding transfer payments to retirees such as Social Security and Medicare) equals approximately $23.5 trillion in real, inflation-adjusted 2015 dollars.

And yet, in spite of this massive expense, the poverty rate has tended to stubbornly remain between 12 and 15 percent, and income inequality has risen unabated. Lest you think this large expenditure is merely an artifact of the rise in population over this period, consider the following data: annual per capita federal, state, and local government outlays on means-tested poverty programs have increased from $291 in 1950 to $2,866 in 2015.

That is a per capita increase in annual poverty relief expenses of over 886 percent in 65 years! Yet, as the following graphic illustrates, the secular trends in income inequality and per capita poverty expenses have risen in lock-step since the late-1960s:

Bottom line: redistributing income and “sharing the wealth” simply do not work.

Indeed, redistribution may actually be worsening the rise in income inequality, as the above chart suggests.

Correlation is not causation, of course, but the positive association between per capita poverty spending and rising income inequality is telling.

Furthermore, economists are persuaded that free trade, lower tariffs on imports, globalization, “cheap” foreign labor, or legal or illegal immigration explain only a small fraction of the rise in income inequality since the 1970s. Were income inequality primarily a result of these international trends, rising income gaps would be isolated in the import and export industries connected to international trade, or most apparent among the workers in industries dependent upon immigrant labor.

However, research consistently reveals that income inequality has been rising across most industries and occupations by roughly the same magnitude, in both the traded- and non-traded-goods sectors, immigrant and non-immigrant related occupations alike. The conclusion reached is that the source of rising income inequality comes from something other than strictly cross-border flows of goods and people.

The source of rising income inequality must be a variable that impacts traded- and non-traded-goods sectors roughly equally. Thus, tariff hikes on imports or other restraints on trade, or further restrictions on legal or illegal immigrants, are likely to have no impact on growing wage dispersion, but would certainly harm our economy in countless other ways.

If the rise in income inequality is not a consequence of a rigged capitalist game, social injustices, or international trade and immigration trends, then what is the cause?

In a word, the answer is “technology.” Understanding why requires us to revisit the basic principles of supply and demand.

Most economists now conclude that rising income inequality since the 1970s is a result of positive and invaluable structural transitions in the broader economy brought on by innovation and the advances of technology, especially the technological change that impacts the production side of the market; what economists call “skill-biased technological change” (SBTC).

New technologies such as the microprocessor, production automation, and robotics, raise the demand for high-skilled labor (think engineers, chemists, software developers, bio-technicians, data analysts, actuaries, and health-care and financial services professionals).

These new technologies are complementary to skilled and educated workers. By raising their marginal productivity as a complementary input, technological advances increase the demand for high-skilled labor and thus quickly push skilled wages higher. In other words, rapid technological change causes the demand for high-skilled workers to rise faster than supply, putting upward pressure on the wages and salaries of the most skilled and educated workers in the labor force.

These same new technologies reduce the demand for unskilled or semi-skilled labor (think blue-collar manufacturing, agricultural laborers, and retail or household service workers). New technology becomes an easy substitute for low-skilled and less-educated workers. By lowering marginal productivity due to these substitution effects, new technology decreases the demand for the less-skilled, leaving the wages of low- or even semi-skilled workers flat or declining in real terms. In these low-skill occupations, the supply of labor exceeds the demand.

Technological advances are highly beneficial, as most people intuitively recognize. They are the primary source of economic growth. They make possible much greater levels of output with the same or fewer inputs, and make available a much wider and higher-quality array of goods and services than ever before. That is, these new technologies accelerate the creation of wealth and the enlarging of the economic pie for everyone in our capacity as consumers.

However, these new technologies do cause rising inequality as they drive up the demand for skilled workers faster than our educational and training infrastructure can reasonably supply it. As the demand for skilled labor continues to outpace supply, the wage gap between skilled and unskilled workers grows, and along with it, the broader trend of rising income inequality.

We can thus understand rising income inequality as a race between supply and demand for high-skilled, educated, and talented workers in an economy undergoing fundamental structural shifts where “working with your brain” is valued far more than “working with your hands.” It is really no more complicated than that, once we strip the issue of all its emotional, political, and ideological baggage. These forces have always been at work in market economies.

In hindsight, it is easy to observe their effects in farming during the first half of the 20th century when internal combustion engine technology allowed trucks and tractors to replace low-skilled field hands, permitting much greater levels of output and much lower food costs for consumers.

Solutions will not be found in redistributing income from the rich to the poor. That has been tried and is clearly failing, and may actually create perverse incentives that restrain human capital investment and reduce the supply of skilled labor. Nor will solutions come from closing off our borders to trade and immigration. That will merely retard growth, shrink the economic pie, and leave everyone worse off overall.

The only way to restrain or reduce the rise in income inequality is to increase the supply of high-skilled labor faster than the demand, suppressing the wage gap between high- and low-skilled workers. But that may not be feasible.

Given the somewhat glacial pace of learning and acquiring high-level cognitive skills, or apart from immigration reforms that would suddenly permit legal entry of more foreign skilled workers into our markets, demand may outpace supply for some time.

As such, rising income inequality is likely here to stay, a condition we will need to adapt to rather than resist.

If you want a larger relative slice of a growing income pie, then you must contribute your own skills and abilities toward accelerating the growth of the pie for others by meeting the demand for skills. For those who are willing and able, the wage gap between the high-skilled and low-skilled creates both an incentive and an opportunity to position themselves with the education and proficiency necessary to take advantage of emerging technologies, to make their labor compatible with ongoing technological advances.

In other words, the rising wage gap provides an incentive and presents an opportunity to invest in the human capital that will enable you to make the overall economic pie grow faster, not just for yourself, but for everyone else, too. That’s the upside of the income gap.

RELATED:

• Only Capitalism, Not the President, Can Save the World

• Why a Universal Basic Income Will Not Reduce Poverty

• VIDEO: Who’s to Blame for Income Inequality?