Is debt good or bad? Should you use it?

When I grew up I was taught debt was really bad, you should avoid it, you should pay cash for everything.

And I believed that until I was like 27 years old until I really started to see success with my business, and then I came full circle on this.

I have a friend and a business partner now, his name is Clement, who had me think about this a little bit differently. And you might have heard the phrase, "There's good debt and there's bad debt."

That comes from Rich Dad, Poor Dad by Robert Kiyosaki.

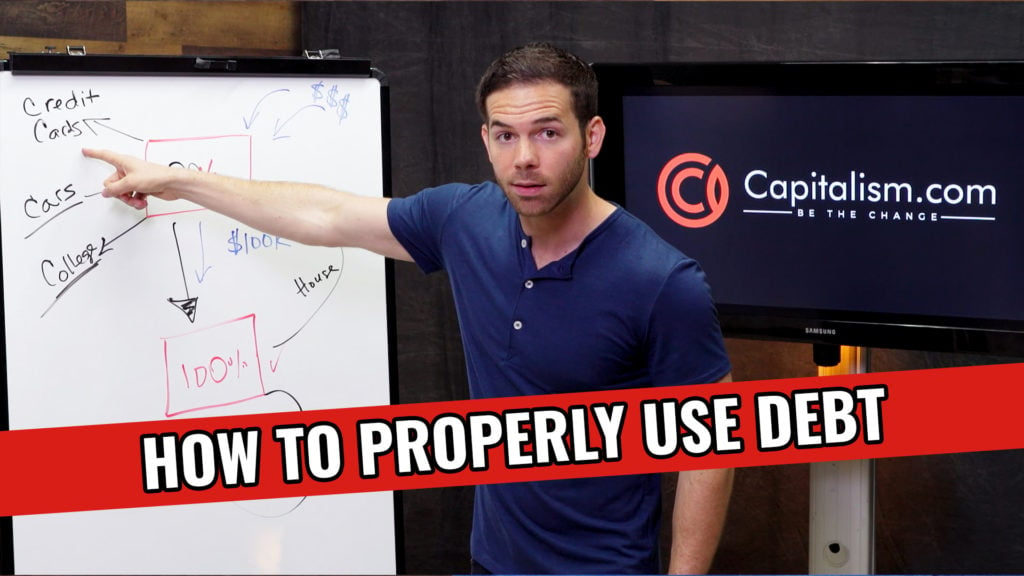

We're going to talk a little bit about that and the difference in how to identify that. So to illustrate this just for a second, let's assume that you've got a five percent, you've got five percent money out there.

Whether that comes from a loan from the bank, or you have a private investor, or this is what you pay for your college debt, or whatever the source of the debt is.

Or if you've got a really good credit card that pays 5 percent.

If so, tell me what credit card that is. So if there's money coming in from outside sources, from The Cloud. This is from banks and investors.

The question is not "Do I take the five percent loan?"

The question is "Where does the five percent loan go?" What do we do with the capital from here?

So, if we have a business and that business as a result of having capital allows us to release a new product, and that product is going to have a 30 percent profit margin and it's going to grow over

time; accelerate sales.

And that capital is what allows us to release a new product, that could literally be 100 percent return.

In fact, when we break down the reason why businesses grow faster than others, it comes down to their ability to turn over inventory.

So the faster you can turn over inventory, the faster your business grows. And by that I mean sell through inventory and replace that inventory quickly. That requires cash.

Sometimes it requires cash that you don't have. Which is where this comes in.

So, if this is a 100 percent return, and I know that sounds silly to some people but in business it happens all the time. I'll take $100,000 and I'm going to take that $100,000, put it into a new product in my business, and at the end of the year I had $200,000 in profit.

So that's 100 percent return, right? In this case, you have spent $5,000 to make $100,000.

In this case, is debt good? Or is debt bad?

In this case, debt really good. We're good here. I want to take this money all day long. Because I know exactly where to put it in my business so that it gets a higher rate of return than five percent.

We could also look at this in a case of real estate. So if we borrow $100,000 to put into a house that has a 10 percent return, and that 10 percent return comes from rent.

If we pay $800 a month to pay this back over 30 years and we're getting $1,000 in rent, we're getting $200 in profit. We're also paying back this debt and the value of the house is going up, is this debt good?

One hundred percent. We're making 10 percent on our money, plus it's going up in value and we're paying off the debt over time. So in that case, debt really really good.

Here's where it gets messy.

What most people think of debt they think of borrowing money to get rid of it. And this would be credit cards, or would be college.

Now, here's where this is different. If you've got college debt because you went to college for general studies and you're hoping to get a degree. Is there a clear way that you can deploy that five percent in your education to earn more over time?

As opposed to a trade school where if you're going to borrow money to go to this trade school and as a result you know you're going to make $65,000 to $85,000 a year for practicing that trade, now we've paid for the debt.

We've paid for the five percent loan, we know exactly what the ROI is going to be and we can make this decision. Whereas what most people do, what most kids do – and the government incentivizes, which is just a ridiculous idea – is they say: "Just take out debt, go to college, you'll figure it out."

And you have these kids who graduate with $100,000 in debt and they can't find jobs. We should not be incentivizing that.

We should not be encouraging people to take on that kind of debt. There's no ROI to that. Zero.

Now, here's where it gets interesting. Especially if you are an entrepreneur or an investor.

Taking out credit cards or taking out five percent debt to spend on cars. This is a really bad idea if you are just going to spend the money.

But recently, I bought a new car; a Tesla. It was $100,000 car. And I took out a loan for it.

Now what would I do that if I'm just spending it on something that some people would call frivolous?

Well I bought it on debt because I got a two percent loan. So at a two percent loan, what this allows me to do is it frees up $100,000 in capital.

That $100,000 in money that I would have spent on the car, I'm going to take that $100,000 and I'm going to put it here in something that actually creates a return.

I used that money to buy a rental property. So I'm from Cleveland, Ohio. I bought a house for $100,000 in North Olmsted, Ohio.

And that is rented out, it creates a return, it's going up in value, and what did that do?

It allows me to pay this back no problem. And I'm actually getting a return on the money that I freed up. So I'm making, we'll just say it's 10 percent, I'm paying 2 percent and I have a car.

So, we get a three-for here. Instead of spending the money frivolously, or wasting it on what Robert Kiyosaki would call "doo-dads," we took the money, borrowed instead of spending it, bought the car. I'm now making payments on the car that is paid for by the house.

So, I got a free car. Instead I bought a house. I have profit. And I get to have my house, my car, and eat my cake too. That's a really really good use of debt.

Here's-- now I'm going to make it super complicated now. What's really exciting about this, is that this, as this gets paid off as the house gets paid off, as the car gets paid off, if you want to make it super complicated, now we've got value that we could borrow against.

We could literally borrow against the house, again at five percent, and go buy another house. This is what we call a multiplier.

I have a podcast about this on Freedom Fast Lane. You could probably Google "Freedom Fast Lane Multipliers." It's called Only Invest Multipliers. (Click here to listen.)

A multiplier is something that if you have capital, take that money and put it into something that's going to have an exponential return.

So what that might look like is as I have an investment, I can borrow against the investment at an interest rate that allows me to put it back into the investment and it can actually multiply and compound.

Which is really exciting and kind of sexy.

So if we were to totally simplify this, the question of debt comes down to the difference between the ROI you're going to make with money and the ROI you're spending on paying that money back.

Here's a fun story. At Capitalism.com we train people to start physical products, businesses, as a way to be an entrepreneur. So we have free training classes and stuff that you can sign up for that'll show people how to start physical products, businesses.

And there's a site that some people use to fund their businesses called... I think it's UpFund. And UpFund charges like 20 percent to get a loan from them. Which people say is crazy, that's exorbitant, it's like putting it on a credit card.

But, if that 20 percent goes into a product that going to make 100 percent return, I'll make that trade all day long. So the question is not, is this cheap money or expensive money?

The question is, compared to what? Because if we could be growing our business by 100 percent per year and we're not because we're not borrowing then we've actually lost all that growth that we would have. Not to mention the customer base that we would get and all of the individuals that we could then market other products to.

So in that case, debt is a really really good thing. But is all based on what we do with it because if we're spending it versus putting it somewhere we have a higher rate of return, that determines if debt is good or if debt is bad.

This is why people like Donald Trump use a tremendous amount of debt to grow businesses. They keep their capital, invest their the debt into building other things, and that's how they become super uber wealthy.

And that's why debt is not good or bad. It's about what you do with the debt that matters.

I hope you found this video helpful. If so, share this with an entrepreneur or somebody you know who would find value in it.

Make sure you're subscribed on YouTube and on Facebook. Thanks for watching.

MORE FROM RYAN MORAN ON CAPTIALISM.COM

• I Just Paid Trump $300,000 in Taxes, Which is About Half of My Tax Burden for the Year

• How to Take the Next Step After Doubling Business Sales

• Why Culture is the Key to Attract Top Talent to Your Business