One of the results of Ryan’s disappointment with Grant Cardone’s presentation at Freedom Fast Lane LIVE 2015 is that he’s been on the hunt for someone accomplished in real estate investing who could and would teach him how to move beyond the steps he’s already taken. J Massey is the guy he found - and he generously shares his expertise on this episode. J has literally gone from no money in the bank to ultra-successful real estate investor and has done all of it using other people’s money to build a real estate portfolio and passive income. If you are at all curious about building your own real estate investment business, this episode is for you.

You shouldn’t use your own money as the primary funding source for real estate investments.

Many people make a simple mistake when it comes to getting started in real estate investing. Here’s a likely scenario: You find a great deal on a duplex and decide to purchase it. The asking price is $120K and you have $150K in the bank. You buy the property outright thinking that no debt is good debt. But here’s the problem. You just tied up $120K of your own money in a property that will cash flow approximately $700 per month. What’s wrong with that? You could have used that same $120K as down payment on 3 or more properties that would each cash flow that much. So instead of $2100 coming in each month, you’re stuck with $700. Make sense? This is one of the many tips J Massey shares on this episode so be sure you take the time to listen.

Build relationships with property managers in your markets to find the people who make deals.

It may sound a bit counterintuitive at first but J Massey suggests that one of the first things you do if you’re looking to invest in an unfamiliar market is to find the local property managers and work to build good relationships with them. They are the men and women who not only know the rental market in the area but who also know the various agents and wholesalers who actually do deals on property. They can steer you clear of the people who are all talk and no action and point you toward the people who know how to work with you to get properties under contract and purchased. J’s got tons to share on this episode so do yourself the favor of hearing what he’s got to say.

Why real estate deals that are on the MLS are not the ones you want.

During this conversation on Freedom Fast Lane, Ryan asked real estate investor J Massey why he doesn’t look for deals on the MLS or other public listing sites. J had a very simple answer. The deals you find there are typically ones that investors like him have already passed by. That should tell you something. There is something about the deal, in most cases, that makes it less of a deal than it may first appear. Instead of using the MLS J works to build relationships with wholesalers, other investors, and agents in the area who can help him find the unpublished properties he can purchase, renovate, and turn into cash flow machines. If you want to know how to find those kinds of deals you need to hear J’s experienced advice, on this episode.

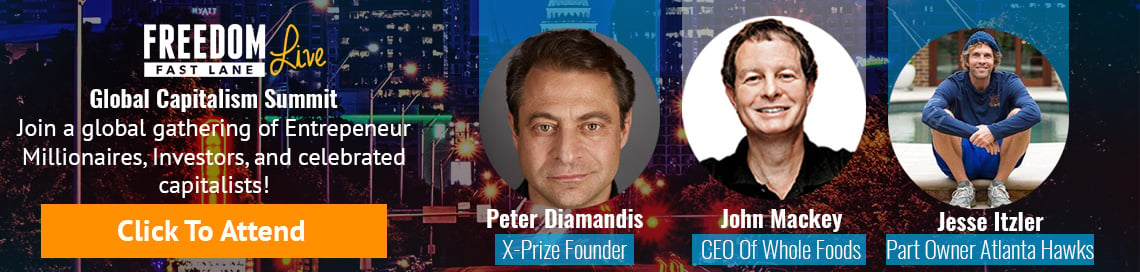

J Massey will be at Freedom Fast Lane LIVE 2016 as part of our investor panel.

One of the great things about the FFL events is that we bring together some of the top names in business and investing to give you an incredible education, one that will take your business and your investment portfolio to a whole new level if you apply what you learn. J Massey will be part of this year's event, serving as one of the members of our All-Star Real Estate Investing panel. You’re not only going to hear from the things J has learned over the years but also gain insight from other successful investors about how you can get started investing in real estate yourself. This one session of the event is going to be worth the price of admission all by itself. Listen to this episode to hear how you can be part of the Freedom Fast Lane LIVE 2016 event.

Outline Of This Great Episode

- [0:04] Ryan’s introduction to J Massey, another guest at Freedom Fast Lane LIVE 2016.

- [2:08] The reason Ryan invited J to make up for Grant Cardone (really).

- [5:35] Ryan’s current situation and J’s response and suggestions.

- [13:58] Why cash flow matters more than portfolio value.

- [15:02] Why wouldn’t Ryan use a bank to finance property acquisition?

- [24:40] Where J finds his best deals (2 strategies).

- [32:20] How property managers can help you find the right realtors to work with.

- [34:54] J’s process for weeding out the deals he doesn’t want.

- [44:30] How J advises Ryan to move forward from here.

- [46:54] The way J evaluates a market for potential investment purchases.

- [50:06] J’s top 11 ideas for getting into real estate investing.

- [51:26] Your invitation to Freedom Fast Lane LIVE 2016.

Action Steps From This Episode

FOR GETTING STARTED: Get clear on the value of leveraging other people’s money to create cash flow for yourself. It’s not unethical and it’s not as risky as you might think because you have a property for collateral that can always be sold to pay off the debt in a pinch.

FOR GREATER SUCCESS: Build relationships with people on the ground in the market where you want to invest. They can save you a long and painful learning curve and help you get deals flowing faster and more effectively.

Connect With Today’s guest: J MASSEY

http://CashFlowDiary.com/Ryan - get your free resources from J Massey

Website: http://cashflowdiary.com

On Twitter

On Facebook

On LinkedIn

Resources Mentioned On This Episode

Connect With Freedom Fast Lane Live

Website: www.FreedomFastLane.com

On YouTube

On Facebook

On Twitter

On Google Plus

On LinkedIn

On Instagram

Subscribe to Freedom Fast Lane

Subscribe to the Freedom Fast Lane Podcast with Ryan Daniel Moran