No, we aren’t talking funeral home directors.

The reason capitalism is so efficient compared to centrally-planned economies is because capitalism is natural.

By natural, I mean it is a system that does not need to be propped up by regulations and laws. Capitalism, the free exchange of goods and ideas, forms without being instructed. Capitalism is the natural equilibrium.

As you probably remember from grade school, in the food cycle primary producers convert sunlight to carbohydrates. They are consumed by primary consumers (herbivores and omnivores). The food cycle moves through the secondary and tertiary consumer, which are then consumed by the all-important decomposers.

The reason we walked off on that tangent is to show that all natural systems need decomposers. Without decomposers, any system would soon exhaust all of its resources.

Capitalism is no exception and has a decomposer system, which is not lumped in with traditional theories of wealth accumulation. They are non-performing assets.

While invention could be considered a primary producer, innovation a primary consumer, and stocks a secondary consumer, the non-performing assets engine can be considered the decomposer of the capitalist ecosystem.

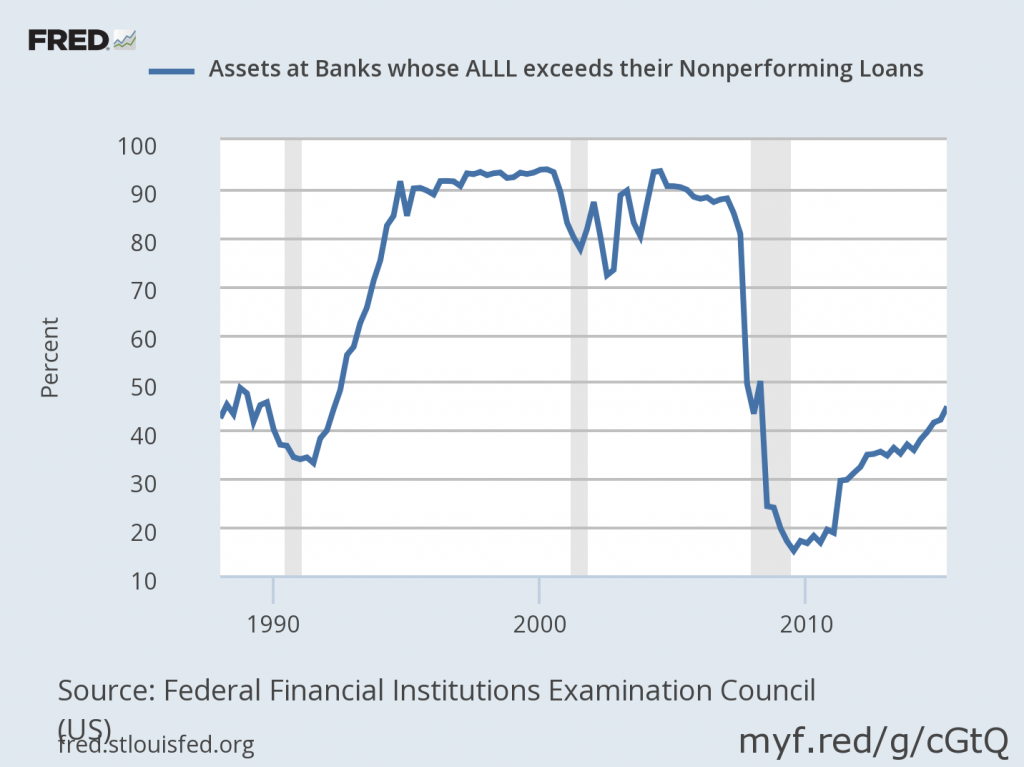

Non-performing assets (NPAs) are a classification of assets held by an institution that have fallen in to default, but still maintain the legal right to collection. Banks actually budget for the likelihood, and it is tracked by the Federal Reserve. This account goes by the acronym ALLL, short for Allowance for Loan and Lease Losses.

As the above chart shows, the ALLL accounts of US banks were stretched to their limits during the Great Recession and still have not come close recovering to pre-recession levels.

However, this difference between current ALLL accounts and pre-recession ALLL is potential gains for the decomposer capitalist.

By being part of the market that helps to breakdown these NPAs, an investor would be able to take advantage of the current back log of NPAs and provide the necessary economic motor to convert these dead assets into fertilizer for future economic development.

This process works because an institution holding an NPA is willing to take a substantial loss to clear the assets in default off their books. When an NPA transfers to the decomposer capitalist, it retains the collection right that existed in the first position.

For example, a decomposer capitalist could purchase the first position on a NPA from a bank for 70 cents on the dollar, and recover the debt at a rate of 85 cents on the dollar. This process would result in a 15 cent on the dollar profit, or a roughly 21 percent return on investment.

If the bank has the same right to recovery as a decomposer capitalist, why would it sell the NPA at such a loss?

It all comes back to the ALLL we previously talked about. Banks can only healthily hold NPAs for as long as their ALLL remains fiscally sound. Once the ALLL begins to approach zero, a bank must unload the assets or risk the solvency of the institution as a whole.

It becomes a simple cost-benefit analysis: hold the NPA long enough to recover a higher-than-market-value return on the NPA (which would still be a net loss to the bank) but risk the solvency of the entire bank, or quickly unload the debt on a decomposer capitalist.

The ability for decomposer capitalists to breakdown “dead assets” into capital that would otherwise slowly poison the cornerstone of capital markets —banks—is an ability that is just as important to the health and well-being of financial markets as the lending system itself.

Like the bond and stock market, NPAs offer an entire world of potential profits for the investor who can properly assess and recognize undervalued positions.

DISCOVER MORE ABOUT CAPITALISM:

• Why Labor in Capitalism Thrives (Hint: Government Cannot Own Labor)

• Misguided Government Intervention, Not Automation, Is the Biggest Threat to Workers

• The Buzz of Capitalism: Creating Robotic Bees to Solve A Big Problem