The Big Idea

Integral has grown aggressively during the past 5 years. Since launching in 2019, the brand has averaged more than 200% year-over-year growth.

Integral boasts a product roadmap focused on automotive travel accessories specifically made for underserved markets. The American design team is dedicated to creating customer feedback driven inventions that resonate with their audience and countless influencers. Integral’s founder grew the brand from an idea to $2.8M in yearly earnings by applying his mechanical engineering background to solve a real problem he experienced driving around the city all day in his uncomfortable truck.

The business is poised to maintain and accelerate market dominance, targeting a $12M-$18M exit in 18-30 months.

Why We Love Integral

Fast-Acting Entrepreneur

An engineering expert with an innovator’s mind and a sharp market sense, founder Jake Lovasz’s ability to use CAD and a 3D printer means he can ask drivers questions about their problems and quickly make his own prototypes. He can turn an idea into a product, and then bring it to market quickly and economically. This has kept Integral at the forefront of industry trends. Coupled with Jake’s keen sense of brand management and his experience patenting designs to create a moat for new products, Integral has a pronounced edge over the competition.

Leading-Edge Products

With a clear vision for the future, Integral launched a number of first-to-market products that have sealed our status as a premium brand in the face of copycat foreign manufacturers. After successfully establishing brand credibility in the family vehicle market, it was time to conquer the truck market, which in recent years has seen strong global sales and high margins. Integral Truck’s impressive development capabilities have allowed us to establish product uniqueness and differentiation, and the team has identified 3-5 user-tested product lines, each capable of adding 7 figures of value to the company.

Outstanding Performance & Satisfied Advocates

Revenue for the past 12 months reached $2.8 million, with an average annual growth rate of 200%. Integral’s 86,000+ global subscribers have been steadily increasing since the first product’s launch in 2019. Several products have gone viral thanks to user-generated content on far-reaching social networks such as Facebook, Reddit, YouTube, and online automotive forums, successfully transforming hundreds of loyal buyers into brand advocates along the way.

Team Members & Strategic Relationships

Jake Lovasz

His background as a mechanical engineer, paired with his dedication to research and rapid prototyping paid off. After investing copious hours reading reviews for products that were trying to fix the same automotive accessory annoyances he experienced, Jake was ready to earn the respect of a new type of customer. Jake identified a chance to serve the active, outdoor-loving Hydro Flask and YETI-toting white-collar workers circulating in urban areas. A persona that similar brands were completely missing.

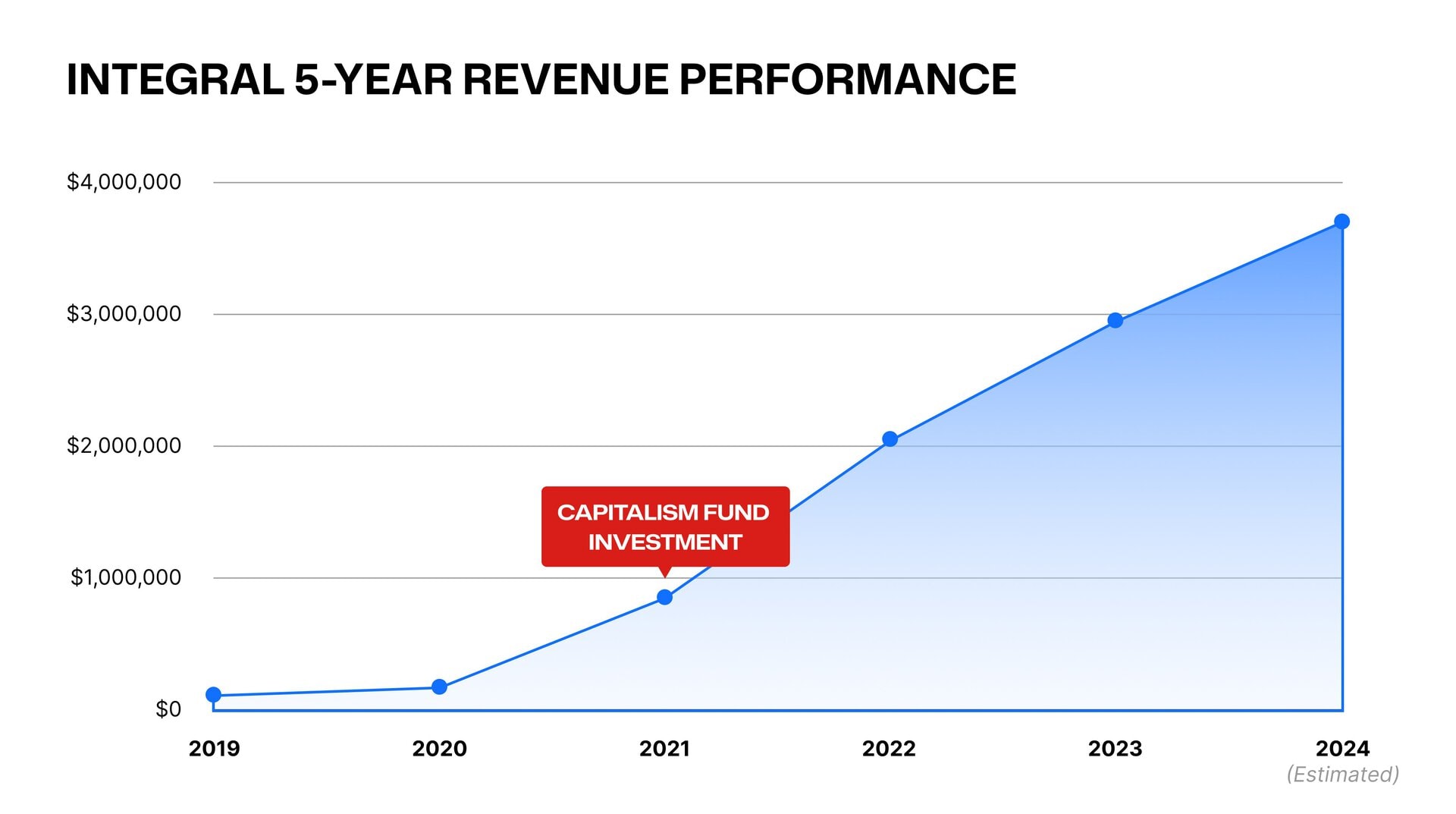

The Capitalism Fund

The Fund began its partnership with Integral in 2021, providing debt and equity capital, advisory, and strategic introductions, resulting in a 10X increase in enterprise value and an 8X increase in revenue during that time.

Influencer Network

These strategic relationships allow us to amplify our brand to hundreds of thousands of engaged followers, for free, accelerating our growth.

SellerPlex

The Gap In The Market

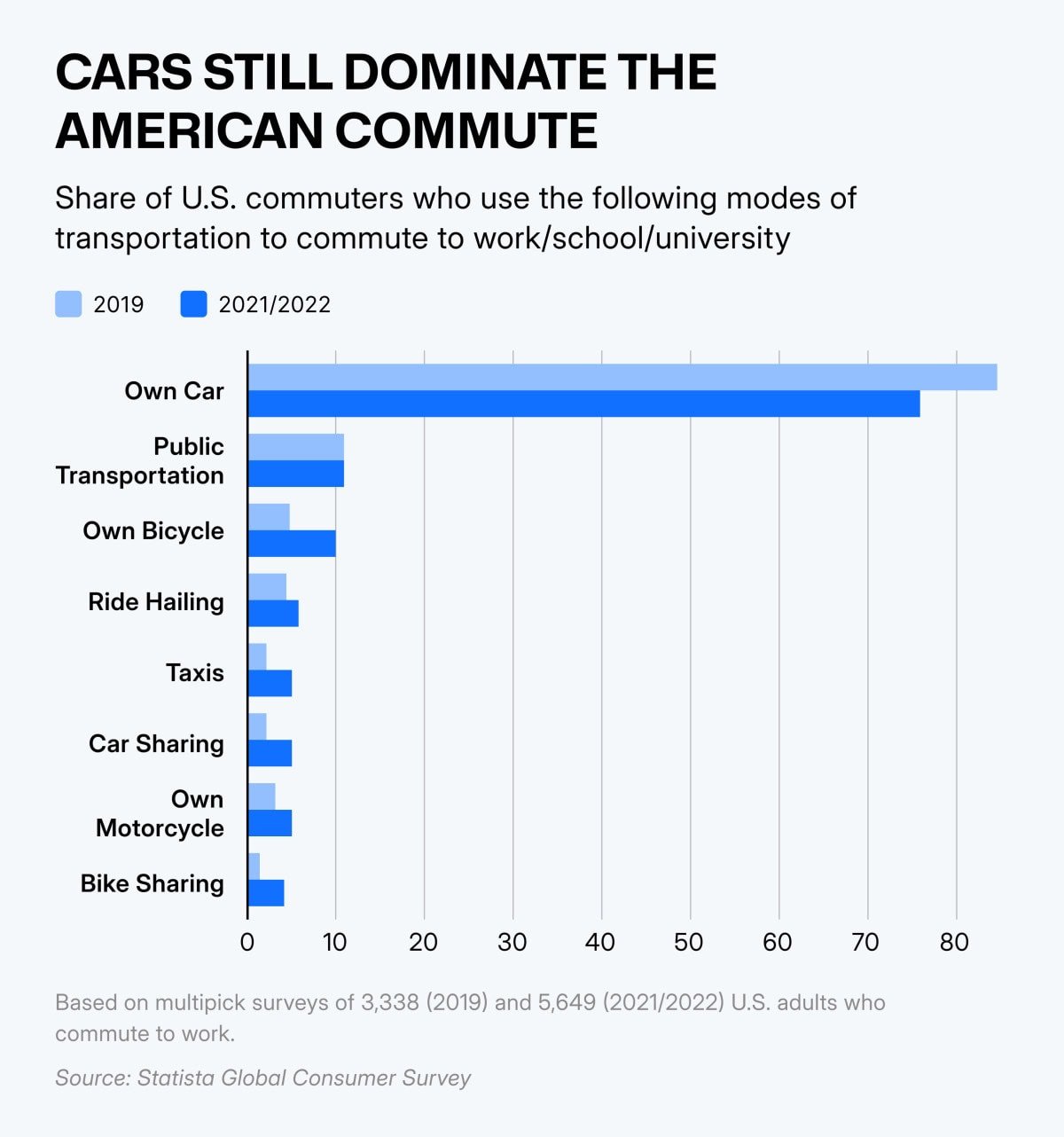

76% of Americans use a car to commute.

Mass-produced, general-purpose cars are built as one-size-fits-all machines and have limitations. They frequently fail to meet customer needs when it comes to ergonomics, storage, and personalization and are not fully optimized for individual user preferences.

Today, established players in the vehicle accessories space remain focused on traditional retail channels like brick-and-mortar stores and wholesale distribution, lacking e-commerce and direct-to-consumer sales models. This prevents them from paying close attention to changing customer preferences, behaviors, and pain points. Their outdated products fail to accommodate our hectic, modern lives, and show a misalignment with real user needs.

What Integral Is Doing About It

Integral outfits vehicles with high-quality products that ensure everyone is properly set up for their desired drive. Our products enhance storage, security, and protection while simultaneously reducing the time it takes to pack up a vehicle for a task or trip.

Our competitiveness in the market is enhanced by strict optimization of logistics, overheads, and prices.

Staying in constant contact with customers through smart brand and channel management systems, we can understand and anticipate changing needs and deploy innovative solutions. This customer-centric, agile business model puts Integral in the best position to lead the industry. We’re always listening and prepared to develop new products, and this first-mover advantage provides an opportunity to patent products and own new market segments.

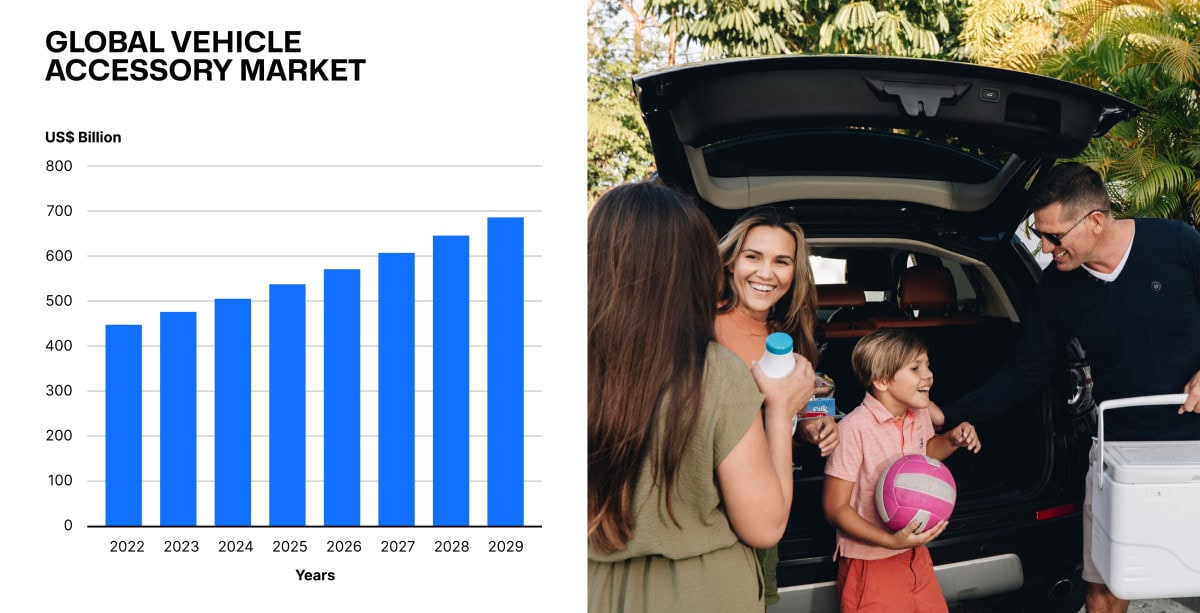

The Opportunity Size

The global vehicle accessory market was valued at $442 billion in 2022. With an estimated compound annual growth rate of 6.30%, that would put the market at over $720 billion by 2030. Interior, exterior, and security accessories make up the bulk of sales.

This growth is primarily driven by increased vehicle sales, security concerns, comfort demands, and a rising need for aftermarket modifications to satisfy personalized driving experiences. The desire for unique aesthetics, improved functionality, and added convenience has made room for a wide range of vehicle accessories.

(Source)

Integral's Unique Advantage

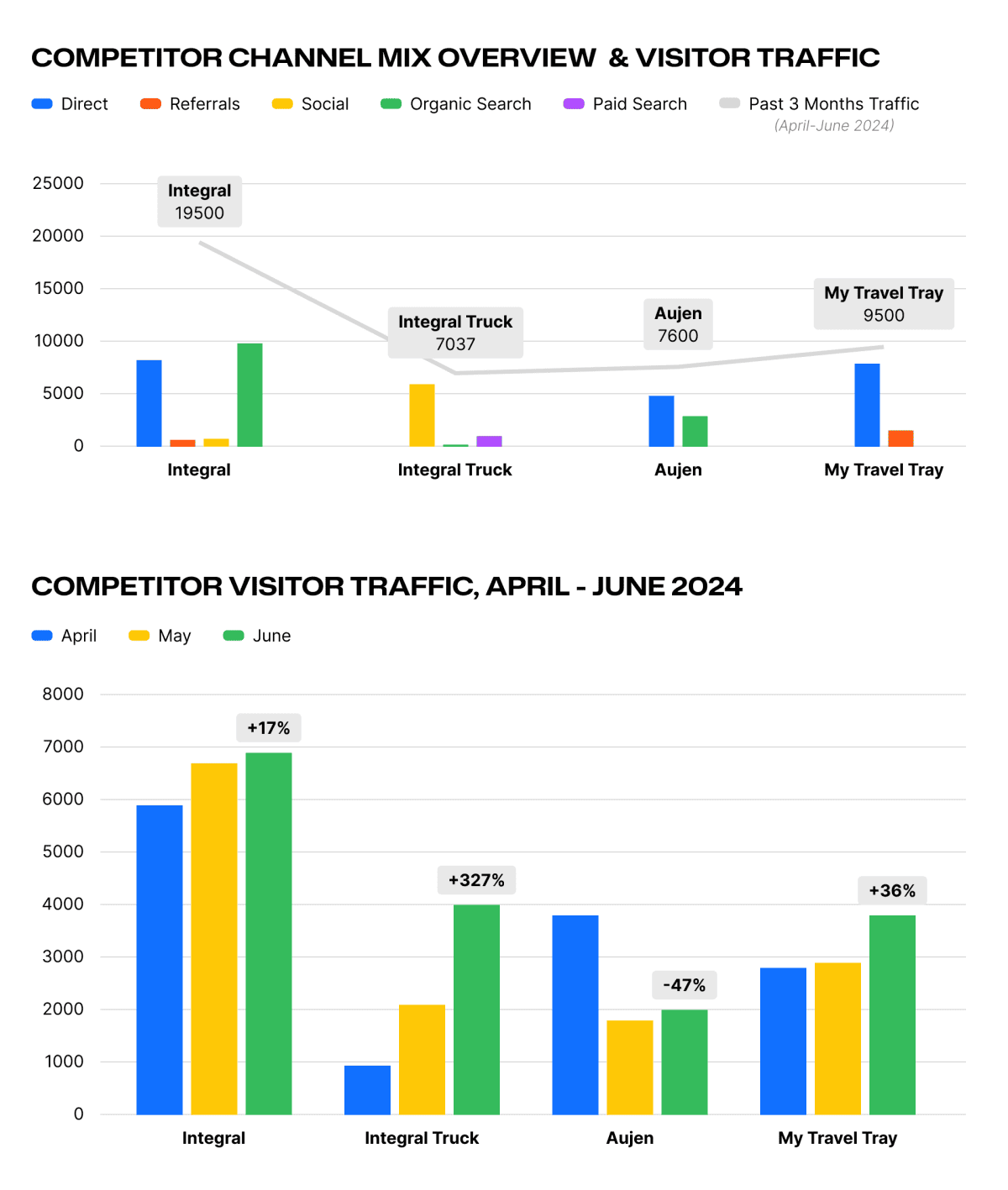

Integral has built a stronger overall brand presence than many competitors, who are mainly single-product Amazon sellers.

Unlike other brands that primarily emphasize driving traffic through sales channels, Integral has cultivated a significant following and authentic engagement on social media platforms such as Facebook, Instagram, and YouTube. This approach goes beyond product promotion to establish a network of brand advocates who share educational videos, user-generated content, and product stories.

When it comes to channels, Integral and Integral Truck are outpacing competitors in organic search and social media. Integral has implemented a robust SEO & paid ads strategy to rank highly for relevant keywords that appeal to our key buyer personas. This is driving brand awareness and traffic that win a crucial advantage over competitors relying solely on paid Amazon ads to boost marketplace presence.

This diversified channel strategy enables Integral to connect directly with customers, foster brand loyalty, and extend online reach beyond e-commerce channels, setting them apart in the market.

Growth Opportunities

Amazon Potential

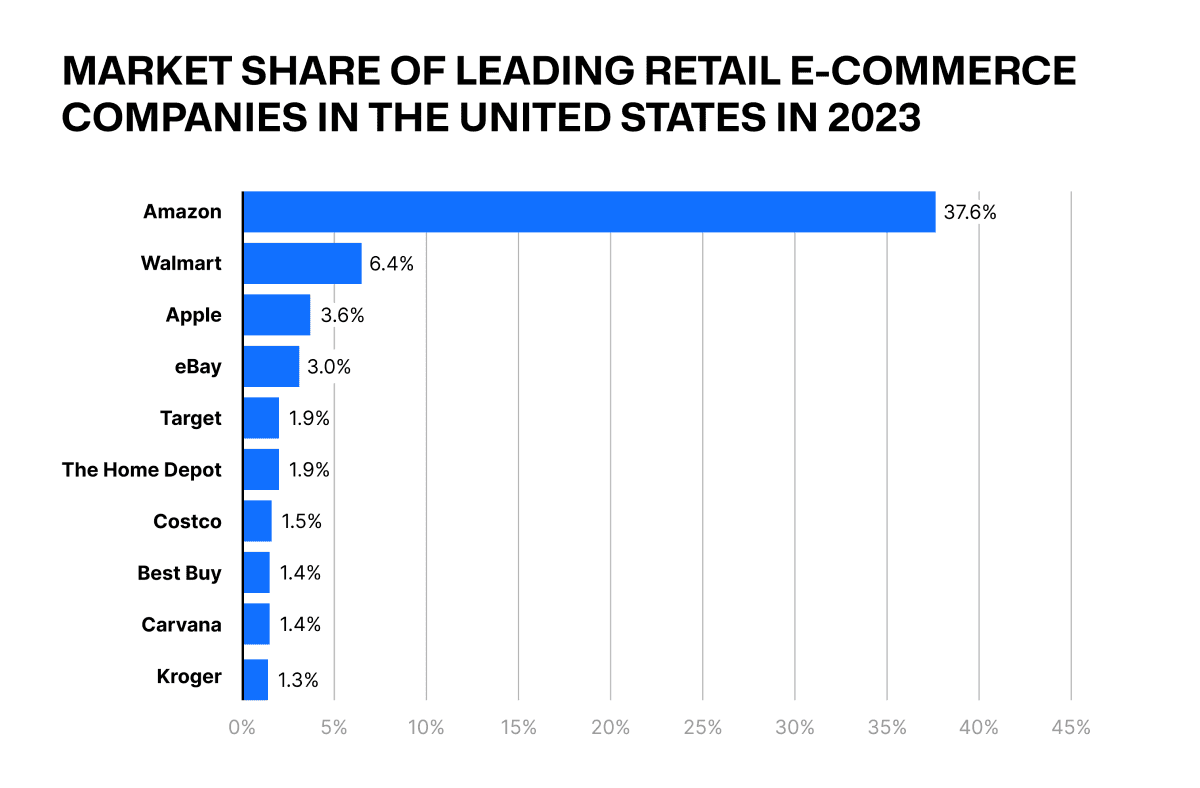

By 2026, 24% of retail purchases will happen online.

As of 2023, Amazon was the top retailer in the e-commerce industry, beating out other online shopping sites with a 37.6% market share.

Amazon's dominant position in the broader e-commerce space means that its strategies and behaviors can have significant ripple effects in the vehicle accessories aftermarket.

Amazon Basics (Amazon’s own product line) released several vehicle accessories with designs inspired by Integral’s high-quality products, signaling the e-commerce giant’s confidence in this category and acknowledging the huge potential to reach customers who prefer online shopping.

Amazon was responsible for $2.3M of Integral’s sales last year. Our proven aptitude for success on the Amazon marketplace is reinforced by achieving key performance metrics indicative of an effective selling strategy.

Integral's Total Advertising Cost of Sales (TACos) of 18% proves that we can generate sufficient sales revenue to cover advertising costs and still maintain a healthy profit margin. This TACoS figure falls within the coveted 15-20% range considered the "sweet spot" for Amazon sellers.

With an Advertising Cost of Sales (ACoS) of 25%, our ad campaigns are optimized to maximize return on ad spend, ensuring each dollar invested in advertising translates to worthwhile sales.

These impressive financial metrics position Integral as a formidable player in the competitive automotive accessories category on Amazon, showcasing the brand's data-driven approach to driving visibility, traffic, and conversions on the platform.

Integral Truck Wholesalers & Influencers

Many influencers who use and love our products have established their own successful Amazon stores, and we have secured wholesale agreements to supply products to several of them.

By wholesaling to these influencer-owned Amazon shops, we can maintain a healthy 50% margin on our pricing, while also benefiting from the established trust and credibility these influencers have with their dedicated audiences. This mutually beneficial relationship not only expands the reach of Integral's brand, but also provides a reliable revenue stream through wholesale orders.

One of the exciting new partnerships we've established for Integral Truck is with the popular influencer, toolsbydesign. Known for his expertise and passion within the tool, home improvement, and remodeling spaces, toolsbydesign has a highly engaged following of over 1.5M followers on Instagram. He recently reached out to Integral Truck, expressing interest in featuring and promoting our products to his community. This influencer is one of many in the 100K+ follower segment who our team maintains regular relationships with, leading to a genuine, sustainable, organic boost in visibility and profitability.

Where Integral Is Going Next

Integral's integrated business model brings together the design, manufacturing, and distribution of vehicle accessories. This streamlined approach allows for greater control throughout the supply chain, ensuring high-quality products. By vertically integrating all aspects of the business, Integral can optimize efficiencies, reduce costs, and directly provide customers with a seamless experience from production to maintaining brand loyalty for the final product.

This business model emphasizes the importance of synergy between different functions within the company to provide customers with best-in-class vehicle accessory solutions.

Historical Progress & Projections

In terms of revenue, the growth story is particularly impressive. From $60,000 at launch in 2019, this doubled to $120,000 in 2020. The next few years witnessed exponential growth as our revenue soared to $800,000 in 2021, $2.2 million in 2022, and an impressive $2.8 million in 2023. This remarkable progress underscores the team’s commitment to excellence and continuous improvement.

Integral is poised to expand rapidly over the coming 18 months. New market-tested products continue to launch and there is plenty of room to grow existing SKU volumes. The leadership team is focused on the highest value activities, while also making the business more attractive for acquisition.

Funds raised will primarily be used for executing the growth plan and the next 5 product launches. The projection for this launch has been validated through both audience feedback and pilot inventory runs. Based on the responses generated from the market tests for each SKU, we anticipate being able to add $4M of top-line sales growth to the company over the next 12 months, and approximately $5M in enterprise value.

The anticipated exit will be to a strategic buyer within 18-30 months, timing the sale to coincide with summer seasonal results or after Q4 sales to maximize value.

Why Now

E-commerce has completely changed the vehicle accessories market. 94% of consumers check the manufacturer’s website for product information before purchasing an item. The market trends show a notable increase in sales for new trucks and SUVs in comparison to the plateaued sales of cars. This growth is attributed to the evolving consumer preferences towards utility and versatility offered by trucks and SUVs.

Trucks and SUVs are also witnessing a surge in accessory sales due to the inclination of owners to personalize and enhance their driving experience. As a result, Integral will continue to cater to the car market while shifting some resources to the Integral Truck brand so we are well-positioned to serve this burgeoning demand by offering a wide range of accessories for all vehicle segments.

Testimonials