Creative real estate investing is not a typical concept you hear about. But Nav Athwal is not your typical tech founder. He has over a decade of experience in real estate as an attorney, broker, and investor. Nav lectures at UC Berkeley Law School and the Haas School of Business, is a frequent contributor to Forbes, and is often featured on CNBC, Bloomberg, and Fox Business. In this episode of the Capital Gains podcast, I talk with Nav about his online real estate investment platform RealtyShares. It’s created to bring investors and real estate companies together to make investments and funding seamless. We talk about how the platform was built and got started, how it works, and the kinds of people who best benefit from being a part of the platform.

Crowdfunding for real estate investment and funding? Yes. It’s true.

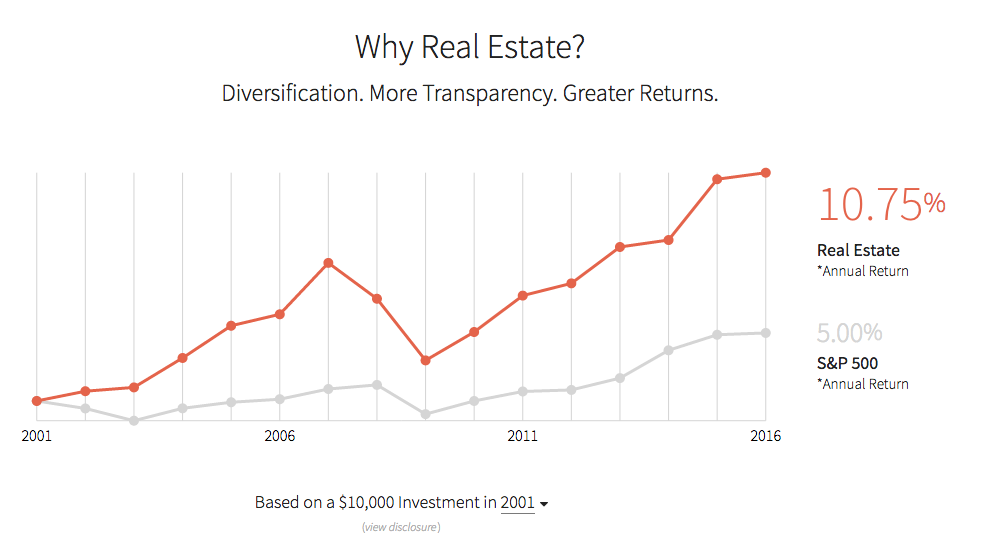

It was only a matter of time before the investment world - and in particular the real estate investment world - caught up with the way that technology and crowdfunding have changed so many other fundraising ventures. RealtyShares is an online platform that enables investors and real estate companies needing funding to come together to cooperate on vetted, verified deals that are poised to make money for everyone involved. On this episode, you can hear how Nav Athwal and his team have put the platform together and why Nav believes it’s on the cutting edge of the real estate investment strategies of the future.

Invest in real estate for as little as $5,000. Really.

Talk about creative real estate investing - this is it. When you sign up for a free account to become an investor with RealtyShares you are able to invest in amounts as low as $5,000 in projects or deals that have submitted all their details and financials - about the deal and the company overseeing it. Those companies are vetted and eventually approved by the experts at RealtyShares. It’s a great way to get started in real estate investing that is free of much of the risk that can happen in unverified deals. Nav Athwal shares how the RealtyShares platform is growing by leaps and bounds because of its simplicity and ease of use for investors, on this episode of the Capital Gains podcast.

RealtyShares is making it possible to get into real estate investing much sooner.

The average real estate investor has to work hard to save up a significant chunk of cash before he/she is able to get in on an investment deal. But Nav Athwal and the team at RealtyShares has made it possible for would-be investors to invest as little as $5,000. It’s possible through the platform’s ability to pool funds from a variety of investors to fund projects that exist within the RealtyShares database so that the real estate developer or company is able to get the funds they need from a variety of sources. The RealtyShares platform only earns 2% of the initial amount invested and the returns on the actual project are what provide the dividend to the investors. Find out more about how RealtyShares works on this episode.

Diversified real estate investing with only $5,000? Yes, it’s possible.

Because the RealtyShares platform combines the investments of many individuals or entities to fund development projects, they are able to spread out the funds of individual investors to mitigate risk. In other words, the money invested is used in more than one project. That makes the possibility of losing an entire investment smaller and the returns more likely. Of course, the RealtyShares team cannot and does not guarantee specific returns but the concept has built-in components like diversification that make it much safer for the average investor. RealtyShares is a great idea and is poised to change the real estate investing world forever. It’s truly creative real estate investing.

Outline of this Episode

- [1:08] My introduction of Nav Athwal of RealtyShares.

- [2:05] How investors and real estate companies are connected through RealtyShares.

- [3:19] Nav’s background as engineer, attorney, and real estate investor.

- [7:40] How Nav put together the plan and team to launch RealtyShares.

- [10:36] What the landscape was like when the platform was first started.

- [16:45] How the initial fundraising effort was so successful (convincing investors).

- [29:20] What kind of investors can use the platform and what’s the minimum investment?

- [34:40] Are “family office” investors looking for different things than typical investors?

- [37:14] The RealtyShares diversified fund and how it works.

- [41:51] Who is an ideal individual investor for RealtyShares?

- [44:50] How you can connect with Nav.

Resources & People Mentioned

Jonathan's Websites

Connect with Capitalism.com

Website: https://www.capitalism.com/

On YouTube

On Facebook

On Twitter

On LinkedIn