This article will undoubtedly enrage some, and dumbfound others.

It’s true that the subject of the corporate structure - and the combination of corporate entities - isn’t conversation of “general interest” at any dinner table. It may likely get your Southern-raised grandmother to “fork” the back of your hand in protest.

But whether challenging polite table manners or “understood tax preparation practices,” I believe comprehending the combination of corporate entities to be one of the most overlooked portals in the Union to financial freedom.

The Early Years

In the beginning stages of my fight against the IRS and the Federal Reserve, I discovered through no small amount of suffering that those two entities are extremely good at forcing folks to do what they want.

In my case, and the case of hundreds of others who I joined in the contention, the government’s position was clear: “Stop digging up law on our unconstitutional nature.”

Whether through threat, personal visit from the “accountants with guns,” levied bank accounts, appropriated assets, or good-old unsubstantiated giant tax bills, the IRS and its cronies did a great job of inflicting torrents of pain on those engaged in the action of exposing these “government agencies.”

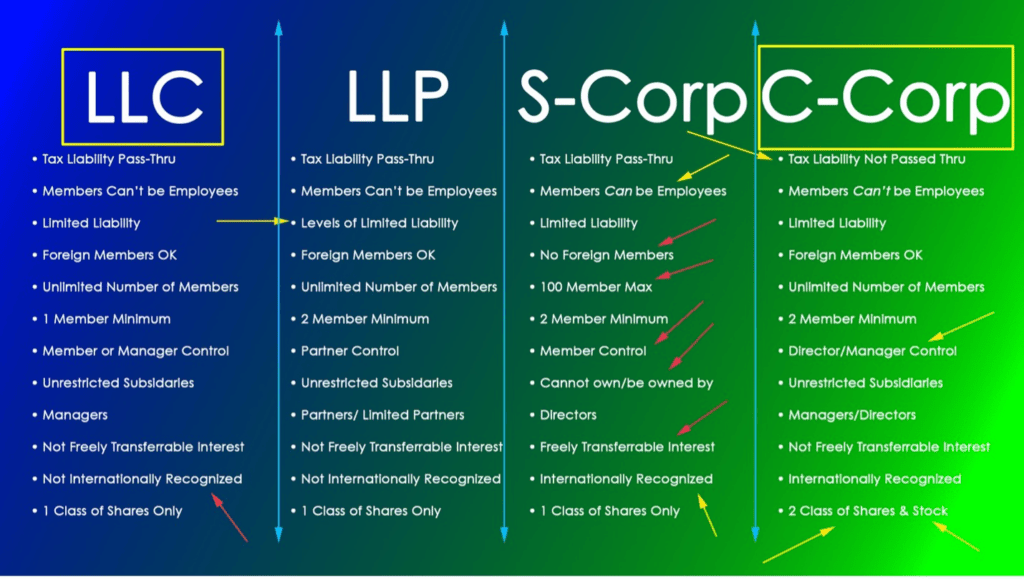

We tried all manner of “asset protection” strategies in order to keep our assets from being taken: trusts, corp soles, not-for-profits, LLCs, LLPs, S-Corps, C-Corps…

Uncle Sam Wants His Cut, and Know How to Take It

None of them were sufficient protection to keep the prying fingers of the IRS from breaking open our corporate structure. Our "mentors" told us that the way to keep the IRS at bay was deploying trusts and foundations. Because that’s what the “elite” do.

But seeing the IRS easily puncture those structures had us realize that the reason these nameless “elites” use trusts is due to their ability to throw a great deal of assets behind their defense. And since trusts exist in only common law and State regulations (when operated in full compliance), they can be assailed at the lowest courts in those States.

And we were fresh out of the billions one-percenters have.

If we couldn’t figure out how to defend our assets in commerce, our fight and intentions would fold. Our finances would be fully appropriated. And our futures ended. We were desperate, and desperation rendered only panic instead of results. We needed a miracle. And we got one.

A Fortuitous Find

In 2007 I was developing the comic book “Omega 1” with a partner in order to pitch a television series. We had just completed the first volume and had the work printed at a local print shop in Burbank, CA. If you know anything about that city, it is home to some of the largest media studios in the world: Disney, the Brothers Warner, Buena Vista, ABC and many others.

As I was waiting for my first-ever comic book to be brought to me at the counter, I noticed what appeared to be a large architectural drawing of a building rolled on large 6’X4’ paper waiting for what I could only guess was a client pickup.

I saw the word “Confidential” stamped across the outside multiple times in bright red ink.

…and there wasn’t really anyone around at the moment…

I quietly took it around the corner of the shop’s counter and unrolled it expecting to see the usual unfathomable draft drawings of a new building. I’m no architect and can barely draw, so I expected 30 seconds of entertainment before putting the drawing back.

But what I saw changed my life and that of thousands of people forever.

It was the entire corporate structure of NBC/Universal Corporation laid out in a flow chart of control and ownership. From the names and locations of the top companies of which you’ve never heard to the retail shops and distribution entities which are household names, it was all there. There were hundreds of companies on this map.

It was a combination of LLCs, trusts and C-Corps in an interconnected web of liabilities, assets and cashflow. It was genius.

And I realized it was the missing link regarding evolving our ability to outmaneuver financial assailants.

After consulting with my friends, we began doing a watered-down version of this connection of diverse entities. Soon after, our situations became tenable once again. So much did our commercial circumstances shift, that we were quickly able to go back on the offense and redouble our efforts knowing that what was once our assets were now the property of something else – which we controlled – and which could not be levied or taken any longer.

We didn’t realize, however, that entities organized in the fashion of NBC/Universal created a structure with unfound proclivities toward Tax Reduction and Legacy Preservation. We had found a holistic solution for the financial vulnerability of the social slave (you and I).

You’re probably thinking, “Well, dude, your silly mission failed. The IRS and the Fed are still printing fiat money and taking people’s labor.”

And you’d be right. After 15 years, we failed in that mission. But we succeeded at a mission we didn’t realize in which we would engage: effective and practical corporate structures for all.

Generalists and Specialists

CPAs, Financial Planners and Tax Attorneys are generalists in their chosen field. Of the three pillars we seek to solve with incorporation, each of these “professionals” is biased toward one at the expense of the others.

CPAs: Tax Reduction

Financial Planners: Legacy Preservation

Attorneys: Asset Protection

Just as we wouldn’t go to a General Practitioner to find a solution for a pulmonary issue, we should not seek a generalist to find a solution for an issue which requires a specialty in corporate structures to resolve.

In my case in 2007, the generalists had failed me.

But at the print shop, I was able to see the handiwork of the Leonardo DaVincis of incorporation, and after quick research in the IRC, we knew we’d struck gold.

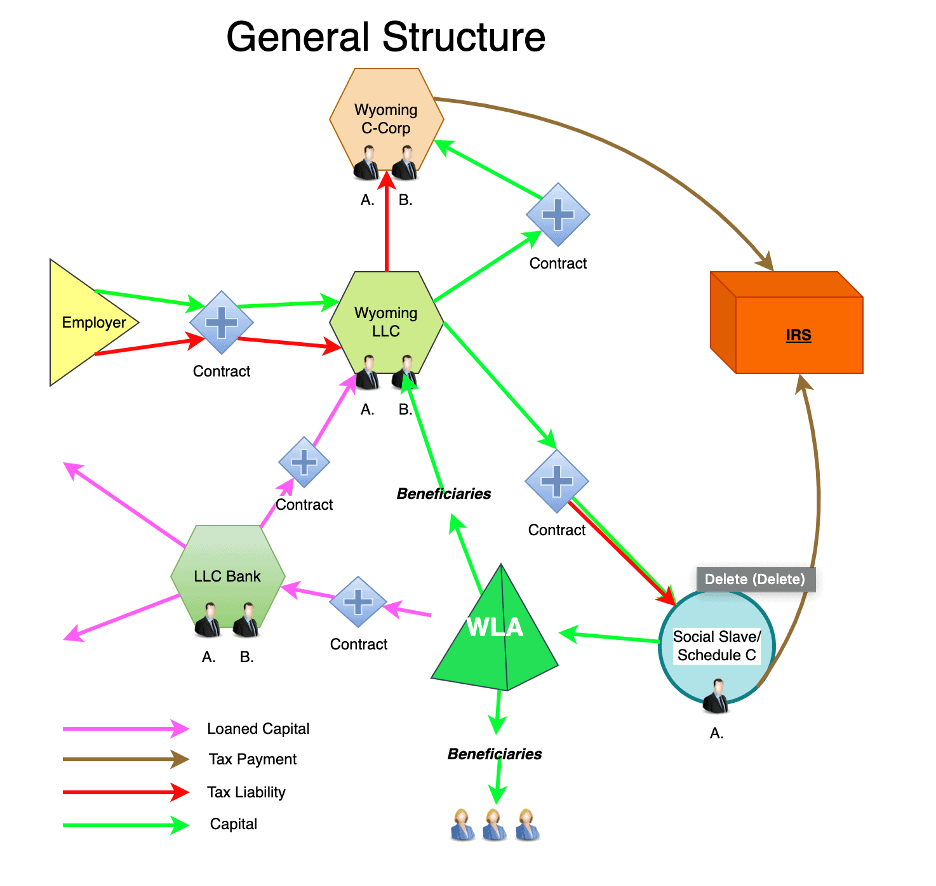

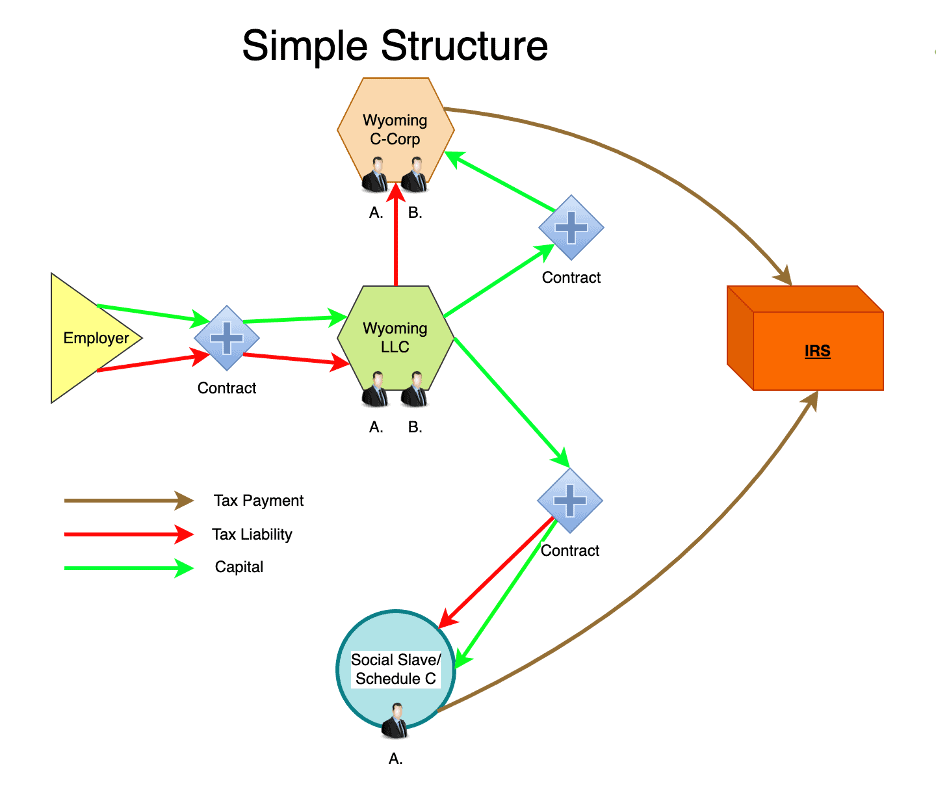

Here’s a breakdown of the structure of the LLC/C-Corp combination. Keep in mind, there are a half-dozen other aspects of this structure to address in order for this to remain effective and compliant. But this brief review will hopefully spawn the kind of excitement for possibility that day in the print shop did for me.

The Entities:

LLCs

Generally, the most widely used Limited Liability entity in America. Also, the most misused entity in America. Typically, formed by the clients of CPAs as “sole proprietorships,” LLCs are “disregarded entities” by the IRS and, incorporated as such, create little tax benefit and even less asset protection.

Pros:

Cons

C-Corps

The quintessential form of American corporation. Rarely used by CPAs due to their belief that C-Corps “double-tax” the earnings of the members. Should someone pay their members as CPAs suggest, they’d be right.

Pros

Cons

We could go on analyzing other more esoteric structures, as I do in my book and masterclass. But it will suffice to say that on that NBC/Universal corporate map there were only three types of structures: trusts (within the corporate structure), LLCs and C-Corps.

We will leave the conversation for trusts to a different article. The elements of a corporate structure cocktail are mainly the latter two. Neither of these three entities by themselves is in any way sufficient to solve for Asset Protection, Tax Reduction or Legacy Preservation. But in their combination, we find miraculous opportunities.

The Protocol

Because LLCs never pay tax, their tax liabilities flow through to their members. However, it’s important to note that the LLC tax liability flows through ownership – not control. And since it’s possible to bifurcate control from ownership in both LLCs and C-Corps, one could create a multi-manager LLC where the managers own a very small percentage of the certificate shares available, but control a large portion of the company.

This allows members and managers of the LLC to have very little tax liability while having a strong voting power in the company.

Where does the tax liability flow to? In this basic structure, the tax liability flows to a C-Corp in a non-tax State (ideally out of the domicile of the LLC). This “parent company” owns the vast majority of the shares of the LLC but has equal voting rights to managers possessing the most voting rights.

An Example

You and your daughter hold 100 shares each in the LLC which has offered 75,000 shares overall. However, in the bylaws and corporate meetings, you and her each get 33% voting rights.

Nice.

But because the C-Corp owns 40,000 of those shares (the vast majority), the tax liabilities flow through that company, not you or her. The C-Corp has 33% control of the LLC as well – as a manager itself.

But because C-Corps – and indeed any entity – is dead, only the living people in the corporation can do anything, the C-Corp must assign someone from its ranks to manage its interests in the LLC.

Who might that be? You guessed it: You.

Now, you, as a manager of the LLC have 33% control AND 33% control as the assigned C-Corp manager – giving you 67% control. But on paper, you have equal control to everyone/thing else.

This kind of “paper identity” may seem “unethical” and “illegitimate.” But it is the foundation of what makes corporate entities powerful. However, most people get into trouble implementing this strategy. That's because they have no idea how to generate compliance with this kind of arrangement.

For certain, it isn’t something you can look up in a manual unless it’s the bylaws themselves. And, for certain, those bylaws had better be dyno-supremely-great and allow for maximum flexibility in order to be of value. But when so done, managers of this structure can have a massive amount of flexibility to benefit the company and the members.

As for the parent corporation, who is in the C-Corp and what does it do?

Well, the C-Corp mainly does nothing. It holds assets up to $250,000 away from the live-fire risk of business in the real world. A company which could have no cause of action brought against it has a built-in Asset Protection capability.

And like the tax liabilities of the LLC which pass through to the C-Corp, excess profits may pass to the coffers of the “holding company” C-Corp as well. Assets, in kind, move into safe keeping in the C-Corp, since corporations exist in perpetuity unlike their trust counterpart which have end-dates.

The inclusion of a C-Corp in this structure provides an incredible amount of benefit to the structure outside of what I've mentioned here. But that is an explanation for another post.

Payment

“But how the heck does anyone get paid? You’re certainly not paying them from the C-Corp!” the CPAs will say.

And they’re correct.

Getting paid by the C-Corp in distributions or in profits is a huge mistake. The C-Corp must pay 21% tax on its earnings. And THEN members who receive distributions pay taxes at “max pain” in the amounts of their social slave tax brackets.

Double-Taxation. But that’s why the C-Corp doesn’t pay you.

The LLC does. And neither does the LLC pay you via distributions (except for the $599 minimum if you must). Instead, no one gets paid unless there’s a contract.

No contract? No money.

Everyone is paid via 1099 independent contractorship. Like C-Corps, because LLCs are dead entities, they don’t have the problem of being taxed on the items which keep them alive as their living social slave members do. LLCs aren’t alive, so just about everything they spend money on is deductible.

Yessss! But the IRS isn’t completely heartless towards its obedient social slaves. Although living social slaves don’t get deductions for their living expenses on the whole, the independent contractors DO.

And some of these deductions can be whoppers.

Case In Point: The Business Use Of Your Home As Calculated On The 1040 Schedule C

Last year I had $100,000 in flooding in the finished basement of my home. Total drag. I did multiple disciplines of business in every room in that basement (which I could defend), and it spanned nearly ¼ the square footage of the home.

Using that deduction, I was able to deduct $25,000 of that expense from that allowance alone. Of course, this is a simplification of the process, but the result was very close to $25k.

Getting paid as an independent contractor allows for the maximum use of IC deductions AND the use of the LLC deductions (many more). Whatever profit is left over is taxed at the C-Corp rate of 21% maximum. Just for context, when implemented well, I have yet to see this simple structure render more than 18% tax on folks’ corporate and social slave taxes combined.

Wait… I’m Confused

Hard to believe? Confused? Too much information?

Well, no one said the tax code or conversations on corporate structure were easy. And in an interview with Johnny Carson on 1/3/75, the former Governor of California, Ronald Reagan said:

“We have a tax structure that is so complicated that it takes more brains to figure out your income tax than it does to earn the income. And it needs to be so simple that we don’t need a lawyer or an accountant to tell us what we owe.”

And That Was 50 Years Ago

For now, if there was a summing point to this article it would be this: no single entity will suffice for one’s financial needs. Single entities have too many liabilities to accommodate financial issues in a vacuum. A combination of an LLC owned by a C-Corp solves nearly all of the liabilities of both and amplifies the benefits.

Please do not draw an assumption that this is a simple process any 12-year-old could create and generate compliance.

It would be unwise to attempt any corporate structure of any complexity without:

IRS, SEC, and corporate funded media experts want us to believe that the only source for this expertise lies in the knowledge of those with three letters after their name.

Do keep your own counsel as to what form expertise might take. But I maintain that the best solution for Asset Protection, Tax Reduction and Legacy Preservation is, at minimum, found in the combination of an LLC owned by a non-tax-State C-Corp.

For longer-form media examples of each corporate structure, please visit my Financial Freedom Formula Youtube Channel.

Takeaway

Here at Capitalism.com, we're on a mission to make one million millionaires by 2028. We coach entrepreneurs to build a business and invest the profits. Creating wealth is only part of the equation, though. Protecting it by minimizing - or eliminating- your tax burden is crucial. This article should give you plenty to think about.

That's why we're delighted to bring you such this thought-provoking article from Mark Edward Lewis.

Eager to supercharge your earning strategy? That's the spirit we love to see!

Our FREE Road to $1 Million course has been a turning point for many, and it could be yours too. As part of our goal to create one million millionaires by 2028, we're inviting you to take the first step on your personal journey to wealth. Enroll now and let's get started.

Disclaimer: The views, opinions, and strategies put forth in this article do not necessarily reflect the views of Capitalism.com or Ryan Daniel Moran and should in no way be viewed as an endorsement for Mark Edward Lewis or his services.