Small business health insurance costs are a constant challenge for employers across the United States, and as more people become entrepreneurs it's clear the problem needs to be addressed.

This issue brief examines regulatory actions taken by the federal government over the past 30 years to rein in health care costs for employers, honing in on the Patient Protection and Affordable Care Act of 2010 (ACA), coined Obamacare, and arguments for and against the legislation.

Origins of Obamacare

The ACA's passage was considered the “benchmark” of President Barack Obama’s tenure. In fact, the legislation was intended to place a cap on the high costs of healthcare in the United States while ensuring the quality of care.

The United States had a very noticeable disparity to the quality of care patients received for the prices. This prompted the Democrat-controlled Congress — with presidential support — to expand care to the under-insured or uninsured while implementing a major overhaul.

History

In 1989, one of the main ideas adopted for solving the problem of rising costs was an individual mandate as means to prevent a single payer health insurance system. The individual mandate was championed, years after, by conservative lawmakers to fight economic free riding. Then, in 1993, President Bill Clinton considered a health care reform proposal targeting employers with a mandate.

However, Republicans countered Clinton’s legislative agenda with a proposal that focused on an individual mandate. Clinton’s plan would have mandated employers to supply health insurance coverage to all employees, based on a system of regulated marketplaces selling coverage through health maintenance organizations. The Republican alternative would have required individuals, not the employers, to buy insurance. In 1993 and 1994, the Senate Republicans championed other individual mandate proposals.

Despite major political shifts, the individual mandate never really went away. The ACA was passed in 2010 with provisions mandating all insurance plans in the United States provide basic, essential health services, as determined by the Department of Health and Human Services, while also expanding eligibility for individuals to take advantage of publicly-funded health care. And, the penalties for noncompliance for individuals and corporations would be levied by the Internal Revenue Service.

The Employer Mandate

Upon Obamacare’s passage, almost every aspect of the United States has been impacted. The legislation outlined a variety of plans to expand coverage for people who sought insurance through individual markets and other means. Nonetheless, the law’s mandates on the small business community are case studies of what a reform like the ACA can do.

ACA Employer Rules

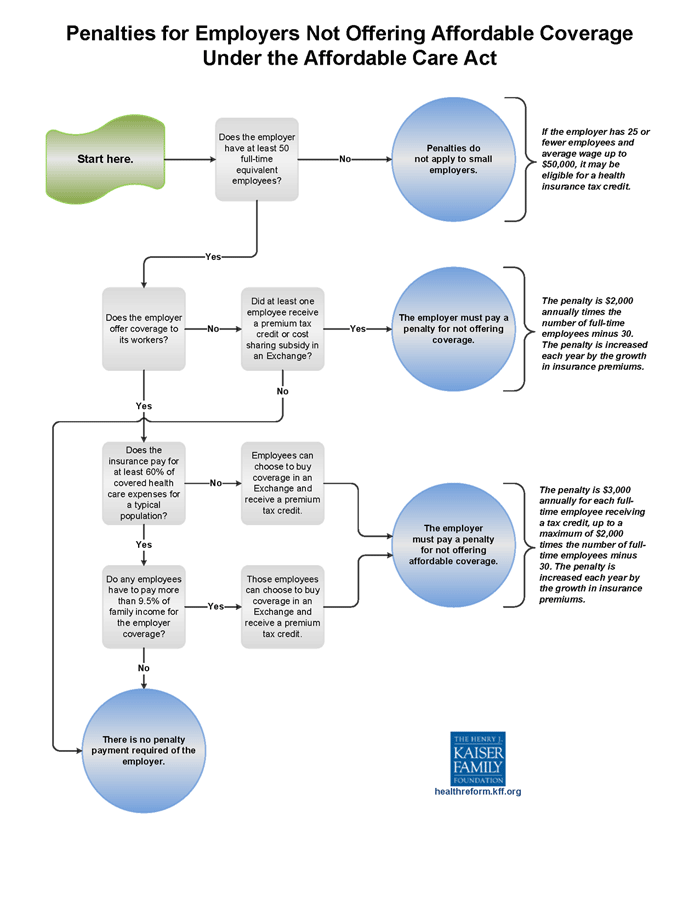

In 2010, employers with less than 50 full-time employees were given special regulations to follow. Notably, small employers don’t necessarily have to meet the mandates of employers with 50 or more employees. However, small businesses are given the opportunity to partake in specialized health exchanges where they can purchase small group health plans. Employers with 25 employees or less, who make less than $50,000 in annual revenue, are granted tax credits if they purchase insurance through the specialized health exchanges.

If employers with more than 50 full-time employees don't provide affordable care, there are penalties.

The mandate on employers to provide coverage dictates that 95 percent of the employees must be covered under employer based health coverage plans, purchased through the specialized exchanges or the insurers. This includes employees that are high-risk patients.

A penalty, known as an Employer Shared Responsibility Payment, must be paid on a per employee basis if the employer does not provide affordable, quality, or compliant health insurance. For large corporations, noncompliance can be a costly avenue.

In effect, all employer provided plans must meet a “minimum value” in pricing and coverage which must cover at least 60 percent of the essential health services criteria. Other penalties are levied when the employer fails to meet the minimum value in health plans provided to employees.

Impacts & Next Steps

The ACA, in addition to bolstering government-sponsored health care programs and implementing individual and employer mandates, set up the federal government as our official negotiator with insurers. This resulted in government-run marketplaces through which employers could purchase coverage at rates the government deems affordable.

Many of the concerns with the ACA conclude it's unsustainable for governments, businesses, and individuals. Over 60 percent of small business owners who responded to a survey conducted by CNBC in 2017 called for the repeal of Obamacare citing the increased rise in premiums.

For example, a 2015 analysis showed that insurers sought double-digit rate hikes on one out of three plans sold in the federal health care exchange, HealthCare.gov. the Los Angeles Times reported in 2016 that rates in the Golden State would rise 13 percent.

With the election of President Donald Trump, Republicans made it a campaign promise that the ACA will be “repealed and replaced” with something that isn’t as costly. Currently, the Senate has begun negotiations on how to repeal Obamacare. If the Senate can come to an agreement on how to do that, a repeal proposal will follow — this being the new mentality adopted as the outright “repeal and replace in one bill,” was chided by Republicans and Democrats.

There is a variety of repeal and replace proposals that are competing among the Republican-controlled Congress. Moderates have limited repeal and replacement proposals at play as more libertarian lawmakers have considered a market-oriented approach. Democrats have advocated for keeping ACA as it is.

Issue Positions

Supporting Obamacare

- “Although the [ACA] is huge and enormously complex, the point of the legislation is straightforward. It aims to fix the market for health insurance by prohibiting sellers of the service from declining buyers.” – Donna Dubinsky, CEO of Palm, Inc., Washington Post, 2012.

- “The ACA extends health subsidies... making health insurance affordable for more low-and-middle-income families.” – Massachusetts Department of Health and Human Services, 2017.

- “The ACA mandate requires everyone to have insurance because the healthy people pull up the sick people, right? As a Christian, my whole philosophy in life is to pull up the unfortunate.” – Tennessee resident, Think Progress, 2017.

Opposing Obamacare

- “The ACA accelerated cost increases for small business owners by mandating new benefits, restricting plan design flexibility, and imposing new taxes and fees on individual and small group market health insurance policies.” – NFIB organizational statement, 2017.

- “The landmark legislation probably won't hold costs down, and it won't let everybody keep their current health insurance if they like it." – Ricardo Alonso-Zaldivar, health care reporter, Associated Press, 2011.

- “President Obama has vowed that health reform will not add a single dime to the deficit -- but he is seemingly unfazed about adding more than a quarter-trillion dollars to the deficit… This latest maneuver only heightens the fiscal irresponsibility...” – Washington Post editorial board, 2009.

Recommended Reading:

- Obamacare Facts – “The Obamacare Employer Mandate”

- U.S. Chamber of Commerce – “The Employer Mandate”

- U.S. CMS – “Essential Health Benefits Standards: Ensuring Quality, Affordable Coverage”

- HealthCare.gov – “How the Affordable Care Act affects small businesses”

- Center for American Progress – “How Obamacare Is Benefiting Americans”

- The Heritage Foundation – “Obamacare repeal and replacement: The case for moving quickly”

Does this help you understand employer mandates for insurance coverage? Did we miss something? Please give us feedback in the comments below.