Our dividend investing series is one of our most popular. But we asked ourselves a simple question. What are the tax implications for foreign investors?

US citizens have to pay tax no matter where they are in the world. But foreign investors have choices on how they can express their views in the US markets.

Before we proceed, it's important to know we advise you to seek your own independent counsel. Capitalism.com is a website trying to educate and entertain, not to give investment advice.

International Taxation for Individuals

There are a few different types of tax jurisdictions in the world that you may be unaware of.

Citizenship-based Taxation

The first is citizenship-based taxation. This is the US system. No matter your location in the world, you're subject to US taxation. This means if you're an American working for a company in London, you will first pay UK tax.

Then, you'll also pay any additional tax that you would have theoretically owed the US government had you lived in the US... on top of what you paid in the UK.

To be clear, you're just topping up. You're not paying the same tax in two different countries.

Residency-based Taxation

Residency based taxation means that you pay tax based on your residency only. For instance, a UK citizen living in the UK pays UK tax rates on his worldwide income, not only his UK-sourced income. That means if you own foreign investments, you're liable for UK tax on them, as well, subject to tax treaties.

Territorial Taxation

Next, we have territorial taxation. Singapore is an excellent example of this. Say you live in Singapore. And you work for a Singaporean company. You pay Singaporean income tax on that income only. Any of your foreign-sourced income is not taxable in Singapore.

To be clear, in this tax regime, any income or capital gains outside of Singapore are not taxable.

No Personal Tax

Yes, these countries exist! Countries such as the United Arab Emirates don't tax income or capital gains at all. The only thing that they have there is a 5% value-added tax on purchases. Unfortunately, if you're an American living in the UAE, you must pay the IRS piper.

The upshot of this is that US investors just eat it. No matter where they are, the IRS will get them. There is no way around it. There are certainly ways for them to minimize their taxes, and being a digital nomad may help. You will be able to take advantage of the foreign earned income tax exclusion. But you'll have to pay the self-employment tax, which can take a bite out of your earnings.

For non-US investors reading this, we assume the following:

- You're not a citizen of the United States.

- You're not a resident of the United States.

- That you're not a green card holder.

- And that you don't pass the "Substantial Person Test."

If you have any doubts, you should talk to a tax advisor and figure this out first. It's critical to determine whether you fall into the IRS's tax net.

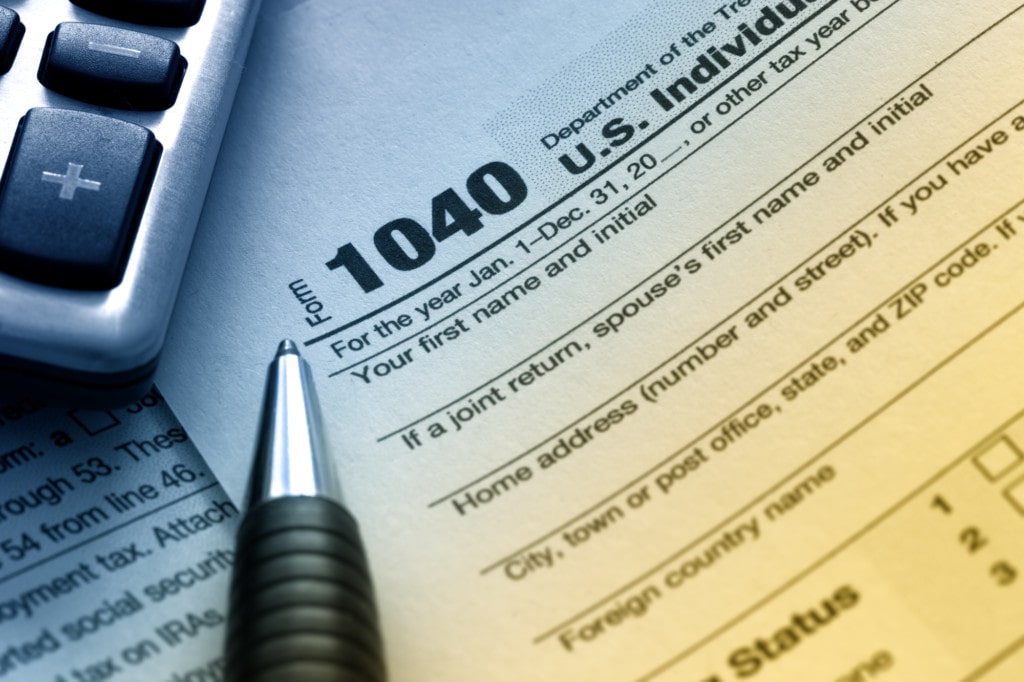

Do foreigners pay tax on US stocks?

Yes and no. Foreigners pay tax on the dividends paid by US companies. But they are exempt from any capital gains tax. That's important, and we'll talk more about that later.

How does dividend withholding tax work?

There's a dividend withholding tax levied on the dividends received by the shareholder. This means the company paying the dividend must subtract this tax from the dividend before distributing it to the investor.

For example, if you receive $100 in dividends, and the withholding tax rate is 30%, you'd only receive $70 from your broker. If your country has a double tax treaty with the US, which taxes dividends at only 15%, you'd receive $85 from your broker.

The key is that the tax is levied at the source, and you don't have to fill out a tax return.

What is the withholding tax rate in the USA?

When you invest in US dividend-paying stocks, your dividends are subject to a 30% dividend tax withholding. While you don't have to file a US tax return, that tax will be withheld.

If your country has a double tax treaty with the United States, you pay taxes based on the lower withholding rate. It varies. Sometimes it's around 15%, sometimes less.

It's simple. You state your citizenship on your brokerage application. Then your broker will withhold the appropriate tax.

Can foreign investors claim back US withholding tax?

Generally, amounts withheld for US taxes are non-refundable. But foreign investors who've overpaid can get a refund.

But, there are different ways to invest in the US markets to avoid withholding tax altogether.

How Non-US Investors Can Earn a Great US Return Without Falling Into the IRS's Tax Net

Invest in Bonds

In general, interest income from bonds is tax-free. Interest incomes, or coupons, from bonds are attractive because they mimic dividends. Bonds tend to stay pretty stagnant in price. Companies just pay you the interest income and then repay you the principal on the bond.

There is generally no withholding tax on registered government or corporate bonds. (Registered bonds are electronically kept on a company's register. So bearer bonds don't fall under the "portfolio interest exemption"):

StackExchange defines portfolio investment income as:

The non-US lender:

- Does not own, directly or indirectly, 10% or more of the voting power of the borrower.

- Is not a bank that made a loan in the ordinary course of business.

- Is not a controlled foreign corporation related to the borrower.

- Also, is not engaged in a US trade or business to which the loan is attributable.

- Provides certain certifications to the borrower under penalties of perjury.

- The loan is in registered form.

- And finally, the interest is not contingent on borrower's revenue, income, equity distributions, or property value.

While the portfolio interest exemption is fabulous, there are downsides.

One is the fixed nature of coupons. They don't grow like dividends. Also, you won't get the potential capital gain associated with an equity market bull run.

There's another downside. When the bond matures, you must find another bond to pay you an equal or better coupon.

Although the IRS won't charge you tax on this coupon, your home country may.

Invest in Non-Dividend Paying Stocks (like Tech Stocks)

Microsoft in the 90s. Apple in the 00s. These companies dared you to sell their stocks for not paying a dividend. Of course, investors hung on for all the stock splits and made enormous amounts of money.

Since foreign investors aren't liable for US capital gains taxes, they can still take advantage of equity bull markets.

But your home country may charge capital gains tax (CGT) on these gains.

Trade Futures

Trading futures is incredibly risky. Just ask any oil traders. But if you know what you're doing, it can be the quickest way to riches. Futures don't pay out any dividends or interest. So foreign investors won't pay any US taxes if you create a capital gains bonanza.

Again, you need to know if your home country charges CGT.

Trade Options

Again, this is risky. If you buy options, you're only risking the premium.

But if you sell options, your risk is much more substantial. If you make a capital gains mint trading these famous financial instruments, you won't pay the IRS any CGT.

Your home country may have different rules. Again, it's essential to check.

Which tax regime you live in and what financial instruments you invest or trade can make an enormous difference to your wealth. It's worth hiring an accountant or lawyer to help you navigate the murky tax waters.

If you want to find out more about taxation, both foreign and domestic, you’d fit right in with the One Percent community. We talk a lot about wealth creation and protection. We also talk a lot about building businesses and investing the profits (check out this free video training - it’ll put you on the right path). That’s because that’s the timeless secret for taking charge of your financial future - and changing the trajectory of your family’s wealth.