There’s no name in the political world right now that courts more controversy. Here's what you need to know about George Soros' net worth. His Open Society Foundations and liberal views make him a target for right-wing and libertarian political observers.

But before he was a Conservative pariah, George Soros was thought of as the world’s greatest investor. In the eyes of many, he was an even better investor than Warren Buffett. Perhaps “investor” isn’t entirely on the mark. He was the quintessential trader, often using his backaches as a signal to take him out of positions.

Before Bridgewater and Renaissance burst onto the scene, most considered Soro's Quantum to be the greatest hedge fund. He started Quantum with future investment luminary Jim Rogers. Soros made Wall Street’s main occupation piggy-backing Quantum's trades. In 1988, Soros hired Stanley Druckenmiller, who helped take Quantum to staggering heights. (The only hedge fund to have returned more capital to its investors is Bridgewater. Currently, Bridgewater is the world’s largest hedge fund.)

Source: Getty Images via Business Insider

Source: Getty Images via Business Insider

In 1992, Soros’s fund broke the Bank of England. Such was the success of this trade that he practically invented Prime Brokerage, the back office service banks provide to hedge funds. The main service of Prime Brokerage is to loan money to hedge funds to lever their trades. Back then, hedge funds were 8-10x leveraged against their capital.

He moved onto Asia in 1997. Contrary to Malaysian Prime Minister Mahathir’s opinion, Soros didn’t start the Asian Currency Crisis. He merely made a boatload of money by riding its wave.

(Stanley Druckenmiller would later say the trade he made wasn’t as profitable as it should've been.)

Let’s explore this heralded investor, best-selling author, and controversial philanthropist’s life.

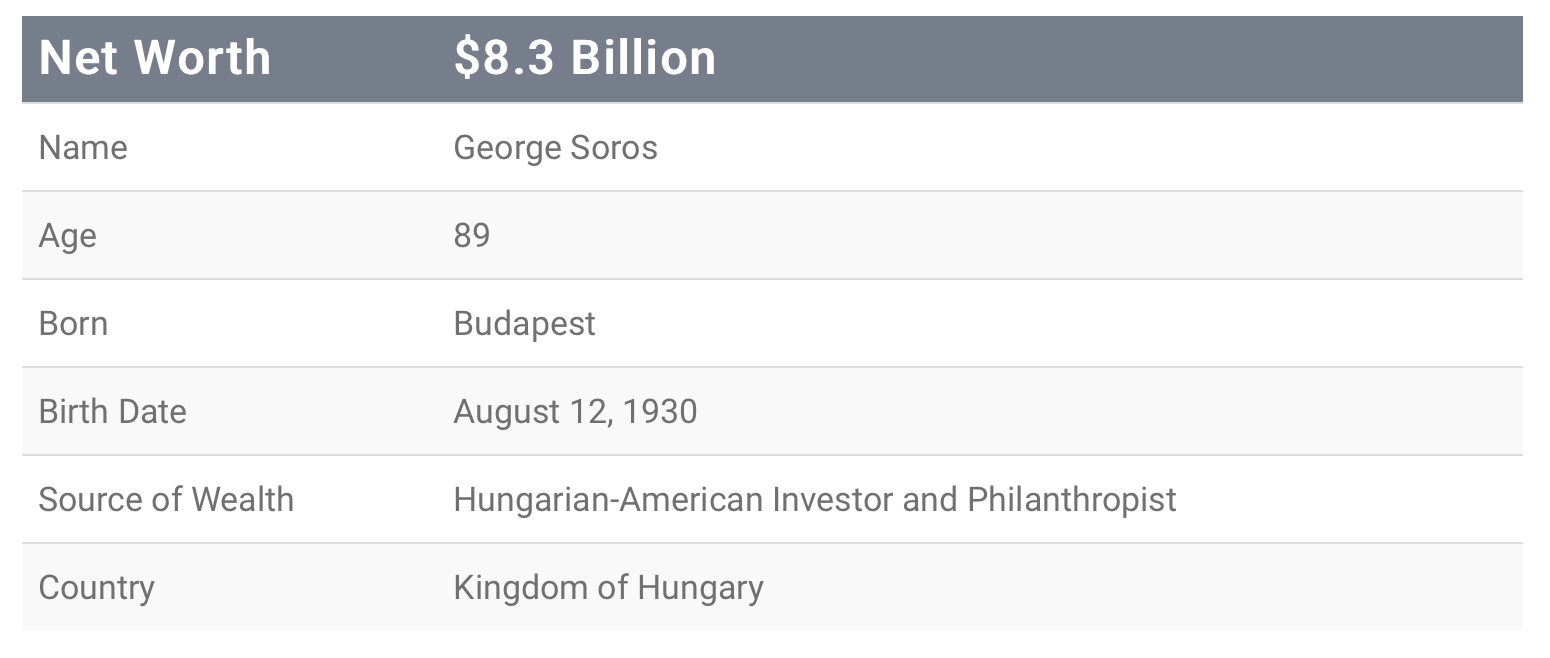

George Soros’ net worth (estimated): $8.3 Billion

Courtesy: MoneyInc.com

Who Is George Soros?

George Soros was simply one of the world’s greatest macro traders. He’s an 89-year-old man from Budapest, Hungary. He calls himself an agnostic Jew, as Jews were beginning to feel the heat of oppression even before the Nazi occupation of Hungary.

Soros lived through World War II and fled to London, where he studied under Karl Popper at the London School of Economics. He earned his BA, MA and DPhil (the British Ph.D. designation) there. Soros went on the thrive as a trader in British merchant banks, American investment banks, and his hedge fund.

What Country Does George Soros Come From?

George Soros was born on August 12, 1930, in Budapest (then a part of the Kingdom of Hungary). Although he has lived in the United States of America since 1956, he retains dual citizenship.

The formative experience of his life was the Nazi occupation of Hungary in 1944. His father, Tivadar, purchased false identity papers for him. He also bribed an officer to claim Soros was his Christian godson. On the one hand, he says, “In many ways it was the happiest year of my life. It was dangerous and exciting. It made me a bit of a risk-taker. And I got to see my father at his very best.”

On the other hand, Soros says:

“The Jewish Council asked the little kids to hand out the deportation notices. I was told to go to the Jewish Council. And there I was given these small slips of paper. It was three or four lines. It said to report to the rabbi seminary at 9 a.m. tomorrow morning. Bring a blanket and food for twenty-four hours. And I was given a list of names. I took this piece of paper to my father. He instantly recognized it, you see. This was a list of Hungarian Jewish lawyers. He said, ‘You deliver the slips of paper and tell the people that if they report they will be deported.’ I'm not sure to what extent he knew they were going to be gassed. I did what my father said. There was one man I shall not forget. I took it to him and told him what my father had said. He said: ‘Tell your father that I am a law-abiding citizen, that I have always been a law-abiding citizen and I am not going to start breaking the law now.’ And that stayed with me forever.”

This incident may explain Soros’s reluctance to finance any Jewish organizations. He is often characterized as hostile towards Israel.

But these trying times forged the billionaire trader he was to become. Let’s explain how Soros does it, by contrasting him to a more familiar investor, Warren Buffett.

How Is Soros Different From Buffett?

Chalk and cheese. Oil and water. That is, George Soros and Warren Buffett are not at all similar.

Though both are successful, each took a completely different path to mega wealth.

Let’s start with Buffett.

(You might enjoy learning about Warren Buffett’s net worth here.)

Warren Buffett made his first investment at age 11. In his early 20s, he studied at Columbia University under Benjamin Graham. Graham is widely known as the father of value investing.

As a value investor, Buffett always searches for underpriced companies he can buy. One of his favorite sayings is, "Be fearful when others are greedy, and be greedy when others are fearful.” (Want more inspirational Warren Buffet quotes? We’ve got you covered.)

For example, let’s talk about Buffett’s famous Coca-Cola trade.

Buffett first started buying shares of Coca-Cola in 1988, right after the 1987 stock market crash. By the end of 1989, he had purchased 23.35 million shares worth $1.8 billion. (He increased his holdings to 100 million shares in 1994.)

It was a bold investment decision, made in the aftermath of one of the most severe market crashes in history.

The stock has split two times since 1994. Berkshire's ownership is now 400 million shares. The cost basis on those shares is $1.299 billion. At the current stock price of $48 per share, Berkshire's investment in Coke is worth $19.2 billion. That leaves an unrealized gain of $17.9 billion on the investment.

The gains are even more substantial when factoring in dividends. At Coke's current annual dividend payout of $1.64 per share, Berkshire's 400 million shares will bring in $656 million over the next year in dividend income. Since 1995, it has earned over $7 billion in dividends from the Coke investment.

You can read more about dividend investing here at Capitalism.com.

But, George Soros is what we’d call a “macro trader.”

Global macro strategists make forecasts and analyze trends involving factors such as:

Soros also runs a hedge fund, whereas Buffett’s wealth is in Berkshire Hathaway, a holding company. It makes a big difference. Running a hedge fund allows Soros to charge both assets under management (AUM) and performance fees. The industry norm at the time was 2% AUM and 20% performance.

Soros also believes that his Theory of Reflexivity guided him to see things others didn’t. Soros believes “the biases of individuals enter into market transactions, potentially changing the fundamentals of the economy.”

Reflexivity is based on three main ideas:

- Reflexivity is observed when investor bias grows and spreads throughout the investment arena. Examples of factors include equity leveraging or trend-following habits of speculators.

- Reflexivity appears intermittently since it's most likely to reveal itself under certain conditions. That is, the equilibrium process is best-considered in probability terms.

- Investors' observation of and participation in the capital markets may influence valuations, fundamental conditions, or outcomes.

It sure worked for Soros, but many believe it’s more of a metaphor than a theory. His son, Robert Soros, hilariously remarked:

“My father will sit down and give you theories to explain why he does this or that. But I remember seeing it as a kid and thinking, Jesus Christ, at least half of this is bullshit. I mean, you know the reason he changes his position on the market or whatever is because his back starts killing him. It has nothing to do with reason. He literally goes into a spasm, and it's this early warning sign.”

It all seems somewhat arbitrary until you see some of Soros’ results. Let’s look at his three best trades, all in foreign exchange.

How Does George Soros Trade Forex?

In a word, “fabulously.” Here’s the story of George, Breaker of Central Banks.

The Man Who Broke the Bank of England

Let’s start with the Black Wednesday, 1992, in London, England. One of the greatest and most famous trades ever. And one that still gives British macroeconomists and bankers the collywobbles.

Chancellor John Major and Foreign Secretary Douglas Hurd convinced the Cabinet to join the ERM in October 1990. The European Economic Community introduced the Exchange Rate Mechanism on March 13, 1979. Its purpose was to reduce exchange rate variability and achieve monetary stability. This was to prepare for the Economic and Monetary Union and to introduce the euro. Finally, the euro started trading on January 1, 1999.

Then, the Government “Helped”

The British government would follow an economic policy that prevented the pound exchange rate from fluctuating by more than 6%.

On October 8, 1990, Prime Minister Thatcher entered the pound into the ERM mechanism at 2.95 Deutsche Marks (DM) to the pound. So, if the exchange rate ever neared the bottom of its permitted range, DM 2.773, the government must intervene.

In 1989, UK inflation was three times the rate of Germany's. The UK had higher interest rates at 15%. And the UK had much lower labor productivity than France and Germany. It was easy to conclude the UK was in a different economic state than other ERM countries.

Soros was so sure the British plan would fail, Quantum Fund borrowed £5 billion and shorted the pound. Why? Because the UK government would have to raise interest rates to a level that would create a deep recession.

The British government spent £27 billion in a single day to support the pound but eventually gave up.

Soros made at least $1 billion from betting against the pound.

Quantum was the leading offshore fund that year. Four of the six best-performing funds were those of Soros Management. Soros himself, dubbed "the man who broke the Bank of England," earned at least $650 million that year.

The 1997 Asian Currency Crisis

Soros also bet against the Thai baht during the Asian financial crisis in 1997.

According to sources, Soros bet just under $1 billion of his total war chest of $12 billion against the baht. There was speculation because he placed such a large bet on baht, Soros helped engineer the Asian crisis.

Yet Soros wasn’t even the most significant speculator to hold a position against the currency. Julian Robertson’s Tiger Fund had three times the exposure of Soros with an almost $3 billion bet against the baht.

Soros himself argued that hedge funds did not start the crisis. He claimed it was Thailand’s central bank's reaction to hedge fund positioning that worsened the problems.

More Government “Help”

Initially, the Thai central bank propped up the baht. It followed with limited currency controls. But it became evident in May 1997 the baht wouldn't hold up. Local companies began selling their local currency for dollars.

"The locals lost confidence in their own currency," recalls a hedge-fund executive in Singapore. "Whether they got tipped off that the central bank was going to end the peg, or they just saw the handwriting on the wall ... it was the same in Sweden, in Italy, in Mexico."

Soros later clarified that he had sold short Asian currencies early in 1997, months before the crisis. "By selling the Thai baht short in January 1997, the Quantum Fund managed by my investment company sent a market signal that the baht may be overvalued," according to Soros.

Ironically, Malaysian Prime Minister Mahathir accused Soros of attacking Southeast Asian currencies.

"This is the whole irony of Mahathir's comments," says Druckenmiller, who managed the trade for Soros. "The only thing we did during the crisis was buy his currency and cushion the decline. I'm not presenting myself as an altruist, because if I'd known what it would have done, I would have sold in the decline. But it was ironic that we played the role of the central bank in the decline."

Betting Against Abenomics in 2013 and 2014

In 2013, Japanese Prime Minister Shinzo Abe ordered extensive monetary easing. The policy known as Abenomics was to jump-start Japan's stagnant economy.

The easing had the effect of devaluing the yen.

At the same time, Soros was long the Japanese stock market index, the Nikkei. The yen weakened around 17% during the time of Soros’ wager. And the Japanese stock market rallied about 28% before eventually selling off.

These bets netted Soros another $1 billion.

In conclusion, Warren Buffett and George Soros are excellent at making money. But they do it in very different ways.

Now, let’s move onto Soros’s charitable endeavors.

What Is The Name Of George Soros Foundation?

George Soros’ most famous charitable endeavor is Open Society Foundations (OSF). Formerly the Open Society Institute, it is an international grantmaking network. Open Society Foundations financially support civil society groups around the world. They aim to advance justice, education, public health, and independent media.

The Open Society Foundations are active in more than 120 countries around the world.

Here are the main themes OSF cover:

What Is An Open Society In Sociology?

How open a society is, depends on the degree of social mobility of a member of a minority group.

A closed society is one where an individual’s role and function can theoretically never change. Such as in the traditional Hindu caste system. A closed society stresses hierarchical cooperation between social groups.

But, an open society allows the individual to change his role and to enjoy corresponding changes in status. An open society permits different social groups to compete for the same resources.

In an open society, an individual's rank is more important than the ranking of his social group.

The French philosopher Henri Bergson coined the term in 1932. Austrian-born British philosopher Karl Popper further developed during World War II. Soros studied under Popper at the LSE.

What Is A Free And Open Society?

A free and open society allows its members considerable freedom (as in a democracy). Popper wrote The Open Society and Its Enemies during World War II. In it, he developed a defense of the open society and liberal democracy. It remains one of the most popular defenses of Western liberal values in the post World War 2 era.

One cannot overstate its influence on a young George Soros. Hence, the name of his charity.

Who Funds Open Society?

In 2017, the OSF announced Soros transferred $18 billion into an endowment that would fund its future work. This brings his total giving to the foundations since 1984 to over $30 billion.

According to Forbes, Soros is #162 on its Billionaires List, with an estimated net worth of $8.3 billion. Clearly, Soros’s net worth would be much higher if he didn’t give so much to the OSF.

One of George Soros’ children, Alexander Soros, is the Deputy Chair of OSF. Alexander Soros’ estimated net worth is over $20 billion. He grew up in Katonah, NY, with George and his second wife, Susan Weber.

But not everyone views the Open Society Foundations favorably.

What Is OSI Russia?

Open Society Institute is the former name of OSF. OSI Russia was its branch in Moscow.

In a press release dated November 06, 2003:

“The Open Society Institute condemns the armed takeover last night of its foundation in central Moscow, the Open Society Institute-Russia. Criminal charges were filed in Moscow today after up to 40 unidentified armed individuals forcibly evicted foundation employees and carted away documents, computers, and other belongings.”

Twelve years later, Open Society would leave Russia for good.

What Countries Is Soros Banned From?

Open Society Foundations has left the following countries:

In 2015, Russia banned the activities of the Open Society Foundations on its territory.

In 2017, the government of Pakistan ordered the Open Society Foundations to cease operations within the country.

Then, in May 2018, Open Society Foundations announced they would move its office from Budapest to Berlin, amid Hungarian government interference. The Hungarian government, led by Viktor Orban, has also moved to get Central European University, founded by Soros, out of the country in 2017. The European Court of Justice has since sided with Central European University and Soros.

In November 2018, Open Society Foundations ceased operations in Turkey and closed their İstanbul and Ankara offices due to “baseless claims.”

In 2019, President Duterte of the Philippines allegedly said of Soros, “There is a special place in hell for you, idiot. Set one foot in this country, and my duty is to make you go straight there.”

Soros’ Personal Life

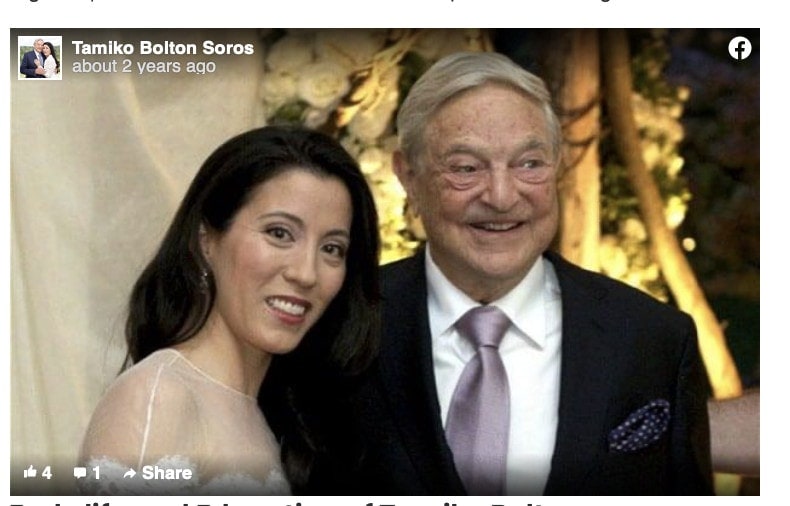

George Soros has been married three times. His most recent marriage is to Tamiko Bolton, who is over 40 years his junior.

Source: AffairPost.com

A licensed pharmacist, Tamiko worked as a health education consultant in the early days of her career. She is a certified Yoga teacher. Tamiko advocates oriental practices for a healthy lifestyle. She has founded a few entrepreneurial ventures that operate online. To provide further education and awareness of yoga, she launched an online platform. Tamiko also owns a successful internet-based dietary supplement business.

George and Tamiko have no children together, but he has five children from his two previous marriages.

“My success in the financial markets has given me a greater degree of independence than most other people,” Soros said.

We’d offer Mr. Soros the same advice we gave anti-billionaire Bernie Sanders.

Tax the Billionaires?

Indeed it has. It’s also given Soros the latitude to ask for a billionaires’ wealth tax. Of course, he can donate some of his wealth here.

Like him or not, George Soros's net worth puts him on the list of the 20th century’s most fascinating men, and he continued to surprise in the 21st century. His words on the financial markets and political scene carry significant weight. At age 89, he’s not slowing down.

Soros is sometimes construed as a former rabid free trading capitalist who’s since embraced socialist causes. But that inherent contradiction only adds to his mystique. One may best describe him as an internationalist, whose memory of Hungary’s Nazi occupation still haunts him. Soros is an unabashed opponent of Nationalism. This makes Viktor Orban running his Hungarian homeland rankle all the more.

But his calls for a global central bank, a global currency (The Alchemy of Finance, Chapter 17), and his Open Society Foundations will likely court controversy for years to come. We bet George Soros doesn’t mind that one bit. It’ll keep him intellectually agile for as long as he lives.

The Takeaway on George Soros’ Net Worth

So, one reason so many people love reading articles like this - about people who've created massive, life-altering wealth - is curiosity. We want to know how'd they get so rich? What are they doing with all that money? What's their life like? It's almost as if there's this invisible wall we want to peer over, to see how "the other half" lives. It's as if the ultra-rich have secrets most people don't know. They DO! And that's good news, actually, because we can all learn them. Once we begin learning what they know, we can do what they did, and create the kind of life most people only wish they had. If you've got that same curiosity about "the other half" you should check this out.