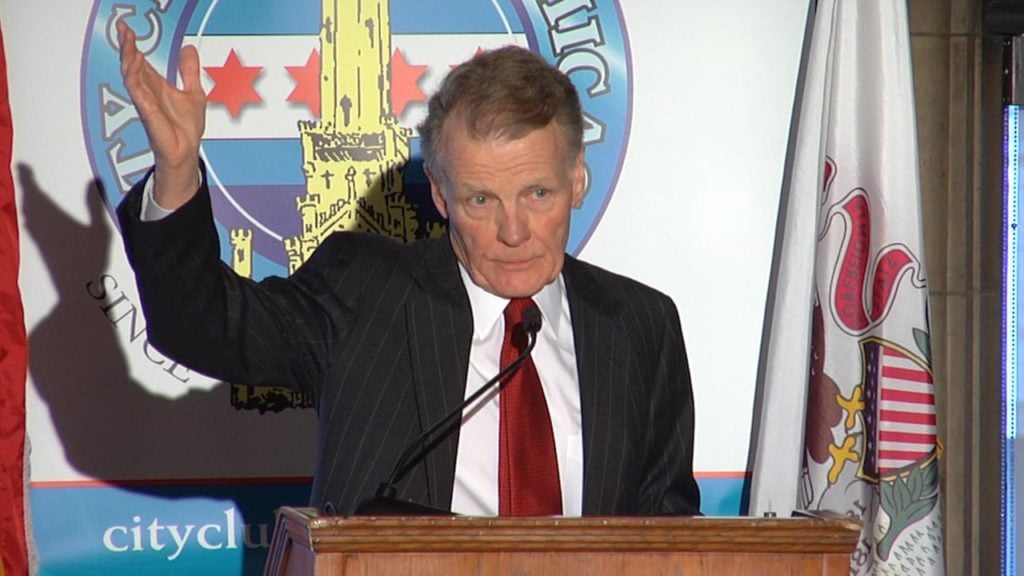

Illinois Speaker of the House, Democratic Rep. Michael Madigan, doesn't seem to care anymore.

Though the House passed a $36 billion dollar budget and a permanent tax increase, no real problems are resolved as billions of dollars in debt and hundreds of billions of dollars linger. But, who cares? Madigan and his cronies don't.

Nothing good can come from a permanent tax hike for the citizens of Illinois and their businesses. The sentiment of spending more than you make doesn't work and will result in a business environment that is toxic for economic growth.

Simply put, the tax hike serves as an example of policy becoming a weapon of political posturing rather than a tool to alleviate the burden the state places on private individuals and entities.

The people who actually care are the citizens and the businesses of the state who now have to make a life-altering decision: to stay or leave for a tax-friendly environment?

Businesses, Then People, Will Leave

Many business owners in Crystal Lake, IL, like the thousands across the state, were astonished and felt neglected by their public officials for passing this legislation. And, they rightfully should.

“They’re making it really, really hard for small businesses to make it these days,” Jack Moos, the owner of Happy Jack’s Sandwich and Fine Ice Cream Shoppe in McHenry, IL, told the Northwestern Herald. “The tax increase is nuts.”

The sentiment is even shared by the Chicago Tribune's editorial board.

"Politicians who've catastrophically mismanaged Illinois finances will spend the rest of their careers trying to cover their tracks and deny the obvious: They've set up Illinois to fail. Raising taxes without major, offsetting reforms piles on years of other decisions that sabotage economic growth," the editorial board wrote in a July 7 staff editorial. "Decisions now driving employers and other citizens to shrewder states."

To culminate the colossal mistake, the effects of pushing citizens and businesses to tax-friendlier jurisdictions will increase. Just in January of this year, a study reported that 60 percent of reasons why Illinoisians and businesses moved out of state was because of the tax environment. It's too burdensome.

The outbound rate for the state in 2016 was also the highest in the country, according to Illinois Policy Institute. Outbound rates for 2017, and the years to come, will only become worst.

Economics 101 (Again)

One component of the tax increase that remains uncertain is the state's plan to pay down its hundreds of billions of dollars in crippling debt. Simply passing a budget for the first time in 2 years doesn't mean the state is out of the woods as the state Democrat-led efforts would suggest.

Taking into perspective that the state of Illinois has a total of $130 billion in unfunded pension liabilities because of lackluster funding towards public employee benefits, the natural result is to pass similar budget bills--regardless of who is governor or who controls the state legislature--that would result in more tax increases, more overspending, and more mismanagement.

It's quite simple when you think about it. The higher the debts grow, the more taxes will increase as political necessities to keep the government open rather than a much need shut down to replenish and re-evaluate budgetary priorities.

Given multiplier effects of negative impacts on the economy, more businesses will either leave or shutter, unemployment will spike, and the welfare and entitlements bill increases.

And no, you can't just tax the rich fat cats running the high-profile businesses found in downtown Chicago. Taxing income from just the rich, plus higher taxes in general, add more costs and grow government. Where government is exorbitant, business and economic activity is sparse.

No wonder people want to leave.

MORE OPINION FROM CAPITALISM.COM:

• Illinois Lawmakers Think $5 Billion Tax Won’t Drive Residents To Tax Friendly States

• How the Federal Reserve Impacts Small Business

• Does Government Stimulus Help the Economy?